Blended funds: don’t get obsessed with leverage

While blended funds offer a plethora of possibilities, it is wise to keep things as simple and cost-effective as possible, finds Christina Moehrle, in the second of a two-part deep dive into ‘the new impact finance kid on the block’.

It’s no coincidence that blended finance, the new kid on the innovative finance block is called “a structuring approach”. The desire to mobilise more investment toward the Sustainable Development Goals relies on the right mix of capital in the right dosage from the right kind of sources. You don’t just pour all types of ingredients into the blender and press the button. Blended structuring is an art and needs to fit the challenge. In particular, as catalytic capital from public or philanthropic funders is a precious spice, it must be put to the best possible use.

IDB Invest voiced this concern in its 2023 report Beyond Leverage Ratios: A Strategic Approach to Blended Finance. The crux: being focused on maximising “leverage ratios” (ie the ratio of how much capital from commercially minded investors the portion of catalytic capital can crowd in) is not such a great idea. In the eyes of Matthieu Pegon, head of blended finance at IDB Invest, efficient blended finance has much more to do with “net social returns that incorporate the wider economic effects and its cost to the taxpayer”.

As catalytic capital from public or philanthropic funders is a precious spice, it must be put to the best possible use

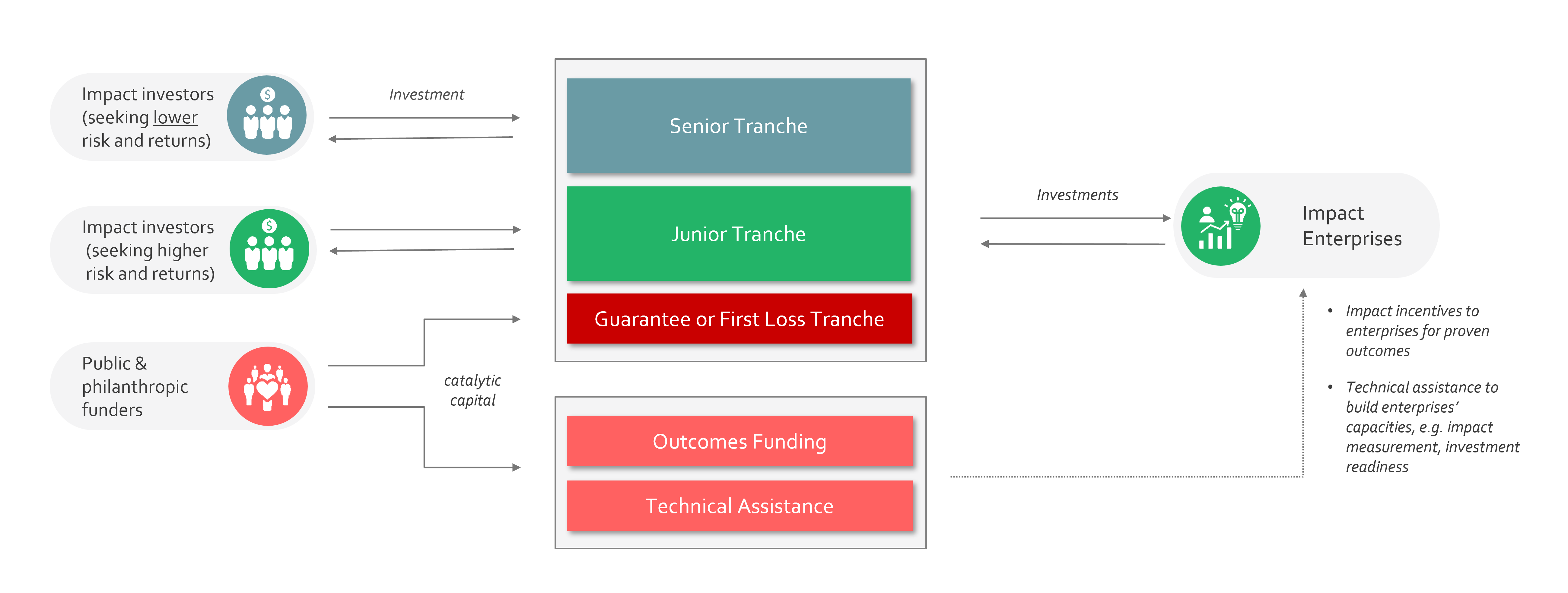

If we translate this into simpler terms, the message is that whenever public guarantees or first-loss capital come into play, they need to be worth the effort. This is specifically true with so-called “layered” or “blended funds”. The idea behind this type of blended finance: if you’d like to finance an entire portfolio, such as impact enterprises in a specific sector, stage, and/or region, you should try to find the sweet spot for each layer. How much guarantee do you really need to sufficiently de-risk the portfolio and make the entire structure work?

For catalytic capital providers, it’s very important to not distort a market. Therefore, too much catalytic capital doesn’t do the trick – and could even hurt an ecosystem. On the other hand, public and philanthropic funders want to create as much “additionality” as possible with their money – even if the exact nature of this additionality is still a passionately discussed term (that is roughly defined here).

How to smartly blend in funds

Clearly, blended finance is not a panacea, and layered or blended funds are just one tool in the innovative finance toolbox. Here, different types of funders provide different layers of capital to finance a portfolio of investments that would otherwise have trouble attracting (enough) capital. For instance, target investees can be early-stage impact enterprises in the notorious “missing middle” or “pioneer gap”, a stage when they are too large for philanthropic funders and too small and risky for impact investors.

- Read more in our Awkward Questions series: Why don't DFIs provide the funding that early stage entrepreneurs so desperately need?

The catalytic layer in the fund typically comes in the form of guarantees or first-loss capital. It de-risks the entire portfolio up to a certain threshold. On top, you have junior and senior tranches for impact investors, each with its distinct size and specific risk and financial return profile. If you want to get even fancier, tie in a side pocket that either funds technical assistance and/or provides impact incentives for proven outcomes. It probably doesn’t get more effective when you use blended funds in an impact enterprise context.

What works in practice

If you have an appetite for financial engineering, it’s very easy to get lost in detail. While blended funds offer a plethora of possibilities, it is wise to keep it as simple as possible and as cost-effective as necessary.

To give one example, the European Commission has launched the EaSI Guarantee Instrument to support the social economy, and specifically micro- and social enterprises, with this type of catalytic capital. Provided by the European Investment Fund (EIF), the guarantee allows to “close the financing gap for companies with limited access to funding”, as European Commissioner for jobs and social rights, Nicolas Schmit, explained the intention behind this approach in 2020.

The European Social Innovation and Impact Fund (ESIIF) was one of the very first impact funds to benefit from this guarantee instrument. Set up as an impact mezzanine fund and initiated by FASE, the ESIIF aims at closing the gap for many European impact ventures that have a hard time attracting the right type or amount of funding. Commitments from direct investors can be matched 1:1 by the ESIIF up to a maximum amount of €400k (matching fund principle). To date, 19 investees in the fund have secured a total of €6m of financing, which leveraged an additional €20m from other impact investors.

The unique blended structure proved to be a game changer for several European impact entrepreneurs, as Lennart Budelmann from aQysta confirmed in 2022: “The unique set-up and co-investment from the ESIIF have provided us with the necessary boost to follow our scaling plan and to close our ongoing financing round at the initial target. For us, the fact that the ESIIF targets our stage of development and is agnostic in terms of geographic focus and sector is something you rarely find in the financing world.”

Design your own blended fund?

To curb your enthusiasm a bit, it’s neither easy nor quick to design, initiate, and fundraise for a blended fund. FASE has learned its lessons, which include:

- the huge importance of securing the guarantee instrument/catalytic part in the structure as well as the right partners (the EIF and avesco),

- the cyclical nature of the investors’ risk appetite (timing for fundraising is key, specifically in times of multi-crises),

- the choice of the right type of patient capital for the target investees (here: self-liquidating mezzanine with a tenure of up to eight years for early-stage impact enterprises), and

- the value of technical assistance (here: investment readiness support to the investees delivered by FASE).

Therefore, if you start your own venture to design a blended fund, it’s smart to use the lessons from the early adopters. The blended finance network Convergence offers a wealth of wisdom on its resource page with many inspiring case studies and best practice examples for all types of structures.

But beware: once the enthusiasm spreads, you might be driven to continue. Right now, FASE is structuring a follow-on ESIIF II based on convertible loans and equity for impact ventures in Europe. The blended finance journey goes on.

Image credit: Jessica Spengler (CC BY 2.0 DEED)

Thanks for reading our stories. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.