Untold Banking #9: Forward-thinking fairy dust

Equity investment is "like fairy dust" to a regulated bank, says Ed Siegel, boss of Charity Bank, which has just made its 1,000th loan.

I’ve only been at Charity Bank for a little over a year, so I had to dig into the archives a bit to prepare for this piece.

12 June 2006. That is the date registered with Companies House when something called the NatWest Community Finance Fund (SE) invested £40,000 into the share capital of Charity Bank. At the time, Charity Bank was just a few years old. It ended 2006 with total assets of £40m and a loan portfolio of £16m. But in the 13 years since then the bank’s loan portfolio has increased more than tenfold to over £175m. I wonder if the folks at what is now known as Social & Community Capital realised at the time how important their investment would turn out to be?

The equity investment in Charity Bank by Social & Community Capital was made with funds from a deposit the organisation already held with Charity Bank. The impact on Charity Bank of that pioneering conversion of the deposit into an even more vital equity investment was extremely powerful and long-lasting.

I wonder if the folks at what is now known as Social & Community Capital realised at the time how important their investment would turn out to be?

Equity investment is like fairy dust to a regulated bank. It underpins everything that we do, and we can leverage every pound of it by about eight times. With £1 of equity investment we can raise about £7 in deposits and therefore have £8 for making loans to our charity and social enterprise customers.

With the deposit of £40,000 from Social & Community Capital we could make £40,000 of loans; however, when this was converted to equity, we could increase our lending by about £320,000. This may not seem like a massive amount today, but in 2006 it represented about 10% of the bank’s net loan portfolio growth for the year.

Perhaps more importantly, the equity investment helped ensure that Charity Bank remained on track towards long-term financial sustainability. Much has happened in the ensuing 13 years – no one who has been associated with Charity Bank throughout this period would deny that it has been a long and sometimes bumpy road! However, we are still here – and so is the investment from Social & Community Capital.

Equity investment is like fairy dust to a regulated bank... We can leverage every pound of it by about eight times.

The early investment from Social & Community Capital enabled Charity Bank to continue to pursue its main objective of providing loan finance to enterprising charities and community organisations, many of which would have been unable to access finance elsewhere. Without this investment, we would have likely needed to ‘take our foot off the gas’, which would have been a setback for Charity Bank in immediate financial terms but also in terms of limiting the number of organisations we could support.

One such organisation is Adrenaline Alley in Corby (pictured left), set up to provide local kids with a safe place to skate. The social enterprise received a loan from Charity Bank to enable it to buy its 5.9-acre site and secure its future. There was a 26% increase in participation after the building was redeveloped and 115,000 members now use Adrenaline Alley.

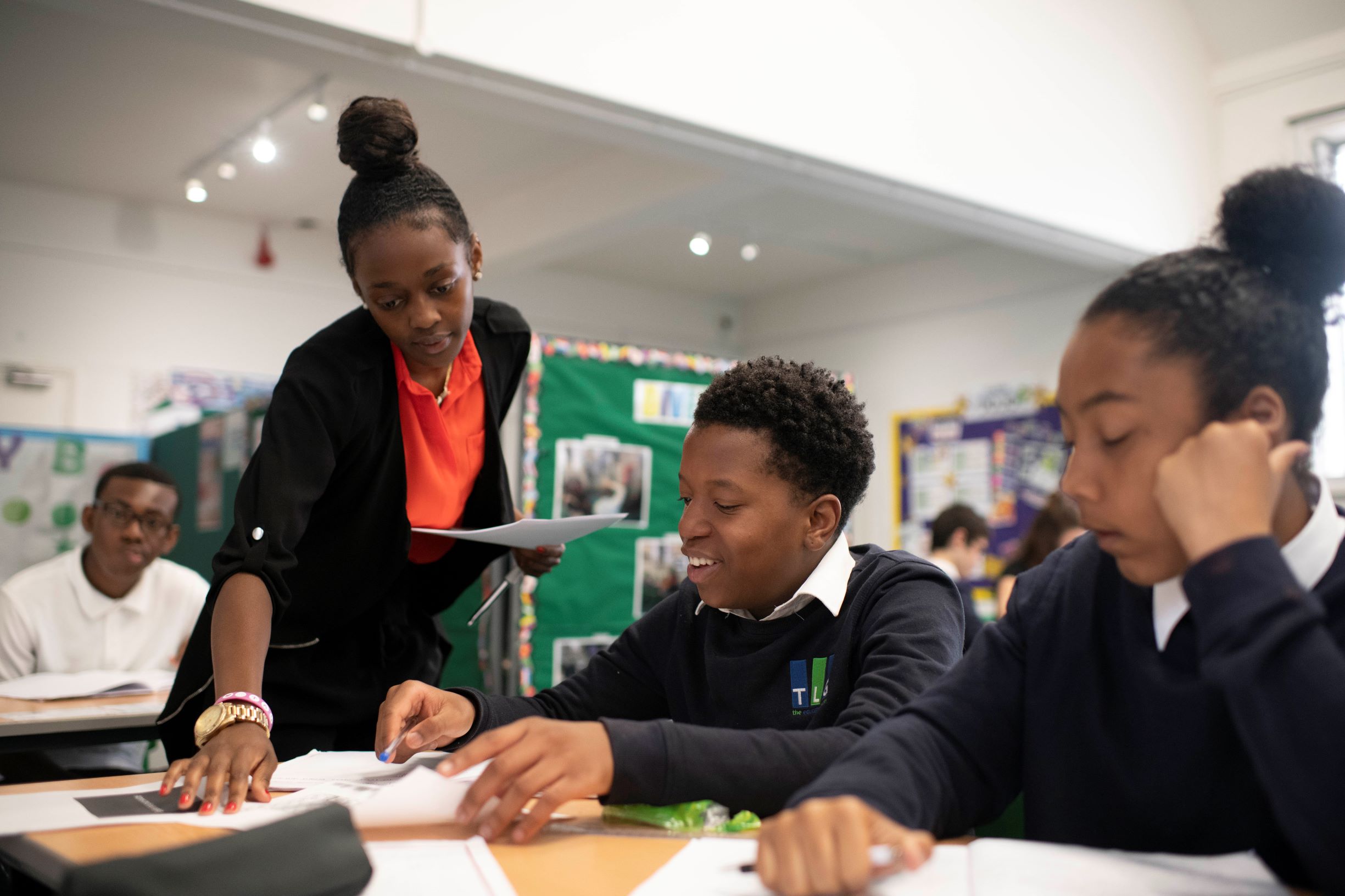

TLG – Transforming Lives for Good (pictured above), which brings hope and a future for struggling children is another example. TLG has used seven Charity Bank loans over 17 years to generate income and support its growth from humble beginnings to one of the UK’s fastest growing children’s charities. TLG works alongside churches to address issues including school exclusion, poverty and holiday hunger. It now helps 5,000 young people each year across the UK.

Without this investment, we would have likely needed to ‘take our foot off the gas’

These are just two examples of the kinds of organisations that Charity Bank has been able to support because it has benefited from the investment of pioneering social investors like Social & Community Capital. Earlier this year, we celebrated passing the milestone of £250m in loans disbursed, and a few weeks ago Charity Bank made its 1,000th loan: a £250k commitment to Andrew Windsor Almshouses to assist with repairs to the roof of the 17th century almshouse, ‘for those in housing need and of pensionable age’.

Our aim is to leave the charities and social enterprises that we work with in a stronger position, not only financially, but also in relation to their ability to pursue their missions. In our 2019 Impact Survey, 100% of our borrowers say that our loan had made a positive contribution to the delivery of their mission.

Every equity investment in Charity Bank has been critical to get us to where we are today. And this will continue to be the case going forward. In order to continue to grow and to support more social impact growth in our borrowers, we will need continued and additional support from patient investors with mixed social and financial motivationss.. Our banking model means that we can leverage social investment to multiply the social impact, but this can only happen with the support of forward-thinking investors like Social & Community Capital.

Charity Bank is the loans and savings bank owned by and run for social purpose organisations. Ed Siegel has been Chief Executive of Charity Bank since July 2018. He joined from Big Issue Invest (BII), the social investment arm of The Big Issue Group, where he was Managing Director for ten years. During that time, BII grew from a book of social enterprise loans of around £2m to a diverse array of social funds under management of over £65m.

This article is part of a sponsored partnership with NatWest Social & Community Capital.