UK pension funds must offer social investment option says G8 Taskforce

All pension funds in the UK must offer a social investment pension option according to a new report conducted by the UK National Advisory Board on social investment.

The report – ‘Building a social impact investment market: The UK experience’ – sets out a group of leading social investment experts’ vision for the next stages of development in the UK’s social investment market. It calls for initiatives in six key areas including pensions, government procurement culture and lending into deprived communities.

The chair of the UK Advisory Board – which was set up by the G8’s Social Impact Investment Taskforce in 2013 – and chief executive of Big Society Capital Nick O’Donohoe said: “The recommendations published today set out a compelling vision [for the UK social investment market] and we hope that other countries will be able to learn from the UK's experience to-date.”

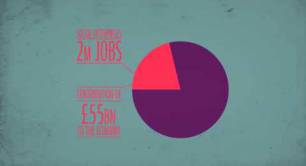

Big Society Capital is the world's first social investment bank and has provided millions of pounds worth of investment into organisations all over the UK that are working to tackle a range of social issues, such as youth unemployment, through sustainable business models. It was founded by Sir Ronald Cohen – chair of the G8's Social Impact Investment Taskforce.

The UK Advisory Board has published its final report alongside three working group reports – Building Capacity for Impact, Recommendation on Procurement and the Social Business Frontier.

James Perry, chair of the working group on the Social Business Frontier and chief executive of Panaphur, said: “The legal and regulatory environment for business and charity in the UK was established in an analogue age where profit and social good were conceived as separate. Certain sectors of business and charity have now moved into the digital age.

Entrepreneurs, investors, charities and governments are collaborating and aligning to create profits with purpose – delivering measurable social value alongside financial value. The time has come for a strategic response in the legal and regulatory environment so as to support, rather than inhibit, these developments”

The final report concluded that in order for businesses delivering social value to be recognised new processes are needed. It recommends that a Social Economy Commission should be launched and a Social Performance Certifier established.

While the Taskforce and the National Advisory Board’s reports mark an important step forward in the development of the UK’s social investment market and those around the world, the project is far from over.

Nick O’Donohoe said: “In the UK there is much more that needs to be done to ensure that charities and social enterprises can access appropriate investment, and to enable more socially-minded investors to enter the market.”

Photo credit: Big Society Capital