Lord of the Rings: A new paradigm in investing

Following the launch of a flurry of social investment reports and the flagship Social Impact Investment Taskforce Report, Jim Clifford OBE, partner at Bates Wells Braithwaite, maps out the road towards a new investment ecosystem.

No-one who attended the launch meetings of this, the second Impact Investment taskforce Sir Ronald Cohen has chaired, or heard him at the big get-together of all involved in June could doubt his heart and passion for this project. A blend of this genuine drive to achieve, and to take the investment community with him, with a committed drawing-in of knowledge from an impressively wide range of contributors has given us a report that is inclusive, challenging, thought-provoking, and grounded in the real world, not stuck in an ivory tower.

The Taskforce was put together during the UK’s Presidency of the G8. With two representatives from each state, plus the European Commission, and other observers, these spanned governments, investors, and the social sector. National Advisory Boards focused on issues relevant to its state, and four pan-Taskforce working groups addressed issues of relevance to all: social impact measurement; asset allocation for impact; profit-with-purpose business, spanning the boundaries between social businesses, and those others with social at their hearts; and international development. Many of the National Advisory Boards also established working groups. The UK Board looked at three: Building the Capacity for Impact; The Social Business Frontier; and Procurement.

One report to bind them

The report…..actually reports… sound like the rhyme from Lord of the Rings: four from the Taskforce working groups; seven from the National Advisory boards, and three for luck from the three UK working groups, and the Taskforce report “…to bind them”.They are available here and here on Big Society Capital's website.

The Taskforce itself has eight main recommendations, primarily for the investment and Government communities. First, and rightly first, all involved should set measurable objectives and track achievement against them. Endorsing the EU standards published in June, it recognises that different measurement is required for different purposes and occasions, and must be proportionate.

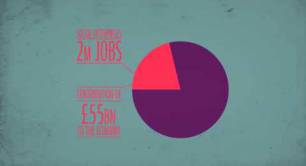

Second it sees a third dimension to add to the traditional investors’ two: risk and return. It is a new dimension to investment thought, but whether it is one extra dimension, or two (social, and environmental), to sit alongside the traditional economic one, each with risk and return aspects, may become clearer over the next few years.

Tackling thorny issues – obliging trustees to look at impact

Not scared of tackling thorny issues, it then challenges us all to expand trustees’ duties to oblige them to look at impact. Legally in the UK it is argued that economic value management is the sole driver for corporates, whether social ly-focused or otherwise. This sits poorly with the purpose of most trusts in terms of social or environmental priorities, so this really does need tackling, possibly through legislation.

Fourthly the report calls for streamlining of payment-by-results contracts and metrics. If that makes them simpler it’ll benefit many, but if this slips into output measures blindly set by commissioners prior to engagement with providers, we risk fostering un-commissionable silliness rather than good and creative solutions.

The fifth request is for wholesalers like Big Society Capital in other jurisdictions, making use of unclaimed assets. The sixth is a plea to all member states to put real support into building further investible organisational capacity in the Social Sector. This is an area where even the UK’s drive to lead in social investment may not quite have achieved all it should. The UK Board’s Building Capacity Group, under the enthusiastic leadership of Daniela Barone Soares from Impetus-PEF, demanded focus not on investment readiness, but on impact-readiness: building capacity reliably to deliver and measure social outcomes.

Super ethical quality marks and social business models

The seventh recommendation revisits the issue of enabling profit-with-purpose business to lock in mission. With ideas and solutions showing the influence of the much-loved Stephen Lloyd, to whose memory the mission working group’s report is dedicated, structures like Community Interest Companies, and Golden share locks need to emerge in other member states, and the development of B Corp and other super-ethical quality marks are seen as key.

Finally, and so relevant when we are all admiring the selfless actions of Alan Hemming, aid volunteer turned hostage in Syria, the application of impact investment in development aid is vital, and needs focus and resource.

Stacked with ideas, and strident in its advocacy of sector-focused sense, this is an important body of work. It must not sit on the shelf, but should live, helping us all to bring the previously invisible heart of investment into view.