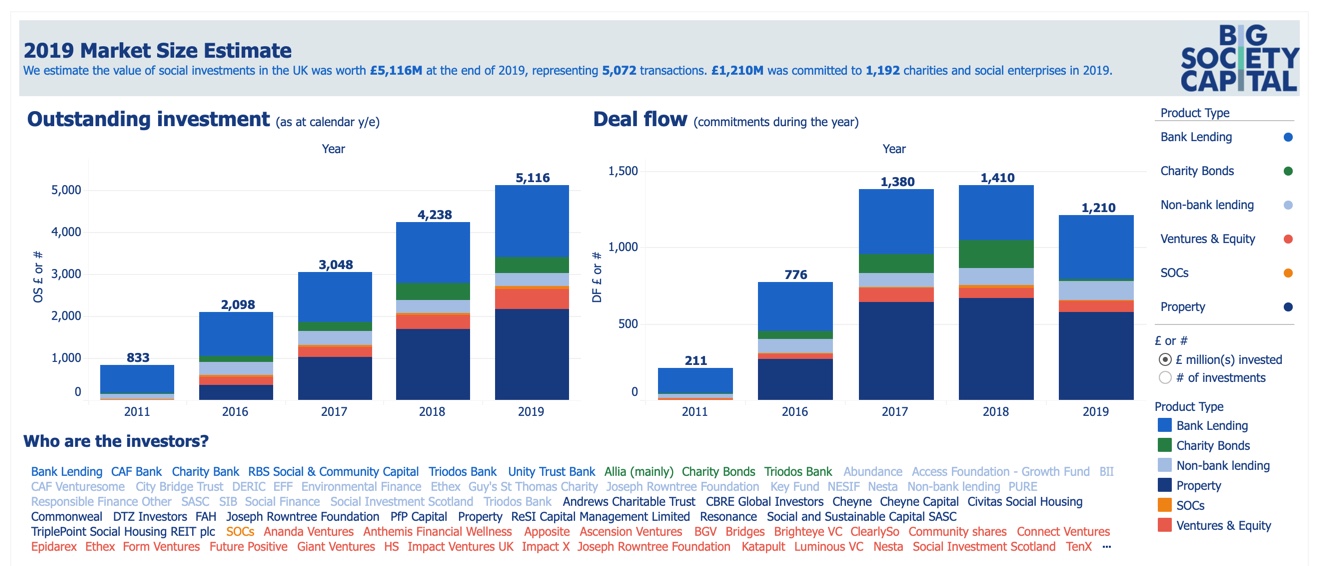

UK impact investment worth £5bn as ‘non-bank’ lending soars, reports Big Society Capital

Impact investing in the UK has achieved a six-fold increase in the past eight years, with non-bank lending and social property funds playing a leading role.

Figures released by Big Society Capital (BSC) today show an increase from £830m in 2011 to £5.1bn in 2019, with a 20% increase since 2018.

The UK’s impact investment wholesaler reports that most of the growth has come from alternatives to traditional bank lending, which have scaled 20-fold from £169m in 2011 to £3,388m in 2019.

“This diversity in the social impact investment market has enabled different types of investor to enter the market and increased the availability of finance options for social enterprises and charities,” BSC said.

Most recently, between 2018 and 2019, there was a little over 20% increase in the value of social impact investments in the UK, to £5.1bn. The number of transactions made increased by 18% year on year to more than 5,000 in 2019, with investment coming from a broad range of institutions, including venture capital funds, social banks, social property funds, charity bonds and specialist lenders.

This diversity has enabled different types of investor to enter the market and increased the availability of finance options

UK impact investment property portion now 42%

Social property funds, which did not exist eight years ago, now account for the largest segment of the market: at 42% of the £5.1bn outstanding social investments at the end of 2019. Social property funds use investors’ capital to create positive social impact, for example, by providing specialist, supported housing for people with learning disabilities.

Ben Rick, managing director of Social and Sustainable Capital, which launched its Social and Sustainable Housing (SASH) fund in 2019, commented: “Supported housing in the UK is an area where social investment can help increase and improve housing stock through impactful, risk-sharing financing for the third sector.”

He said the launch of the SASH fund was “a direct response to the appetite within the third sector to have greater control over local supported housing supply” and that SASH was growing “a new generation of social landlords by scaling up support for charities and their transitional supported housing provision”.

Supported housing is an area where social investment can help increase and improve housing stock through impactful, risk-sharing financing for the third sector

Secured bank debt at 34%

Next to property funds, the second largest segment of the UK impact investing market is secured bank lending, at 34%. This has grown from £664m in 2011 to £1.7bn in 2019.

Despite the rise in alternatives, banks remain “the source of finance still most likely to be taken on by a social enterprise or charity”, said BSC.

Another sector which has seen considerable growth – nearly 50% year on year – is ‘venture investing’, where investors provide early stage and growth capital for innovative ventures tackling social issues, such as preventing mental ill health, childhood obesity and the ageing population.

Big Society Capital's market estimates show a 20% increase between 2018 and 2019

Unsecured lending doubles

BSC also reported a doubling of the amounts of unsecured non-bank lending since 2011, with over 1,600 investments now outstanding, valued at £327m, including blended finance (usually a mix of grants and loans). “Not all charities and social enterprises have assets against which a loan can be secured,” BSC said.

It added that, during 2020, many social enterprises and charities faced “a perfect storm of rising demand for their services and falling income due to the pandemic”. For some who had been adversely affected by Covid-19, social lending had “the potential to be a lifeline during these challenging times and demand is likely to continue”.

Although the impact investment market continued to expand across a wider range of product types, with larger value deals, there was still demand for the lower value deals. BSC said this was demonstrated by the volume committed through the England-focused Growth Fund during 2019 – just under 20% of the total deal flow across the market.

The Growth Fund, which is managed by the Access foundation with funding from both BSC and the National Lottery Community Fund, was set up to enable charities and social enterprises to access repayable finance of up to £150,000.

Seb Elsworth, CEO of Access, said: “The Growth Fund continues to be a cornerstone of social investment in England, with around one in six of all deals in 2019 coming from the programme. Average size investments of just over £60k are meeting clear demand from the sector. These numbers show the vital role blended capital plays and the need for long-term subsidy to support it.”

Stephen Muers, interim CEO of Big Society Capital, added: “It is very pleasing to see the substantial growth in the market to the end of 2019 and the growing popularity of the different investment options available, encouraging a broader spectrum of investors into this market to create greater positive change for people across the UK.

“The impact of Covid-19 has been both social and economic and I believe will be a key driver in shifting investors’ focus from a purely financial return to one that delivers a social impact too. I expect social impact investment to play an increasingly important role as an engine of the economic recovery.”

- To see the data visualised in full, head here: 2019 Market Sizing Data / 2019 Deal Level Data.