Will accountants save the world?

We need ‘warrior accountants’ – but they need to be more radical and more warrior like, says Jeremy Nicholls in his latest column. And the warrior accountant “has more to do than help develop and standardise ESG,” he warns. The risks of businesses’ dependencies on declining environmental resources or below-standard wage and working conditions, for example, should also be “managed and reported”.

In 2013 Peter Bakker, the CEO of the World Business Council for Sustainable Development (WBCSD) said that accountants would save the world and that we needed to change accounting rules. More recently WBCSD has released its Vision 2050, arguing for internalising social and environmental costs and benefits. In 2012, less well and certainly less famously, I had started a website on accounting for value, still up but inactive, in order to make the same point.

More recently, we have had the rise of the ‘warrior accountant’. In 2018, the Financial Times published an opinion piece arguing that the new front for green revolution rests on warrior accountants and in 2020, a professional accounting body, CPA Ontario, published a report on ‘CPAs and the New Social Contract – the rise of the Warrior Accountant’ which said:

CPA: Social justice soldier?

When the pandemic hit, environmental risk reporting had already been promoted from corporate social responsibility sideshow to core business strategy, at least for large-listed companies. Organizations increasingly realize that climate change will have a dramatic impact on the bottom line. Now, social metrics – the S in ESG (environmental, social and governance) – look set to enjoy similar prominence. Investors are increasingly looking for ways to responsibly invest for both shareholder returns and ESG factors like lowering greenhouse gas emissions, tackling inequality, systemic racism, job creation and sustainable long-term economic growth. And in 2020, the covid-19 pandemic accelerated demand for impact investing strategies.

This approach would focus accountants on ESG[1]. Good, but it is time for accountants to push for a more radical change recognising that accountancy will be a critical part of the solution to many of our global challenges.

So we do need warrior accountants, but they need to be more radical and more warrior-like.

It reminds me of that Monty Python sketch where the accountant wants to be a lion tamer but has confused anteaters for lions and so the careers advisor suggests a transition through insurance and banking. We wouldn’t want ESG to be our anteater.

It reminds me of that Monty Python sketch where the accountant wants to be a lion tamer but has confused anteaters for lions

For many, ESG is about financial risk.

KPMG puts it like this: ‘For banks and insurers, the financial risks of climate change are in sharp focus as regulators set out expectations for stress testing and climate risk management. Asset and fund managers and asset owners are being required by regulators and investors to embed sustainable investment throughout their businesses and to consider the full spectrum of ESG.’

For others it is about contributions to meeting the SDGs.

The World Economic Forum puts it like this: ‘The core and expanded set of 'Stakeholder Capitalism Metrics' and disclosures can be used by companies to align their mainstream reporting on performance against environmental, social and governance (ESG) indicators and track their contributions towards the SDGs on a consistent basis.’

These different purposes have different implications for what, and how, information on ESG factors would be collected and used.

The purpose could focus on a business’ contribution to these risks (inside-out information) or on a business’ exposure to these risks (outside-in information). These factors might be the same or they could be different. More importantly, the information required to make decisions taking these factors into ‘account’ will be different. The argument that we need more comparability in ESG reporting to inform investment decisions has been rapidly gaining ground but not always recognising the difference between a business’ contribution to risk and a business’ exposure to risk. This would be a significant problem if standards only address one of these purposes. Either way, somebody somewhere should be using this information and making different, and we assume better, decisions than they would make without the information.

My previous article, on the investor, explored what we mean by better. If you want better financial returns, you’ll be interested in ESG from a risk management perspective. If you want better wellbeing for society overall, you’ll want to know how a business is managing its financial returns and its consequences for people’s wellbeing. These consequences could be referred to as social and environmental returns or as positive and negative changes to the wellbeing of people and planet. For the remainder of this article, I’ll just call them ‘impacts’. This is the perspective that warrior accountants should be taking and is where accounting has a significant role to play.

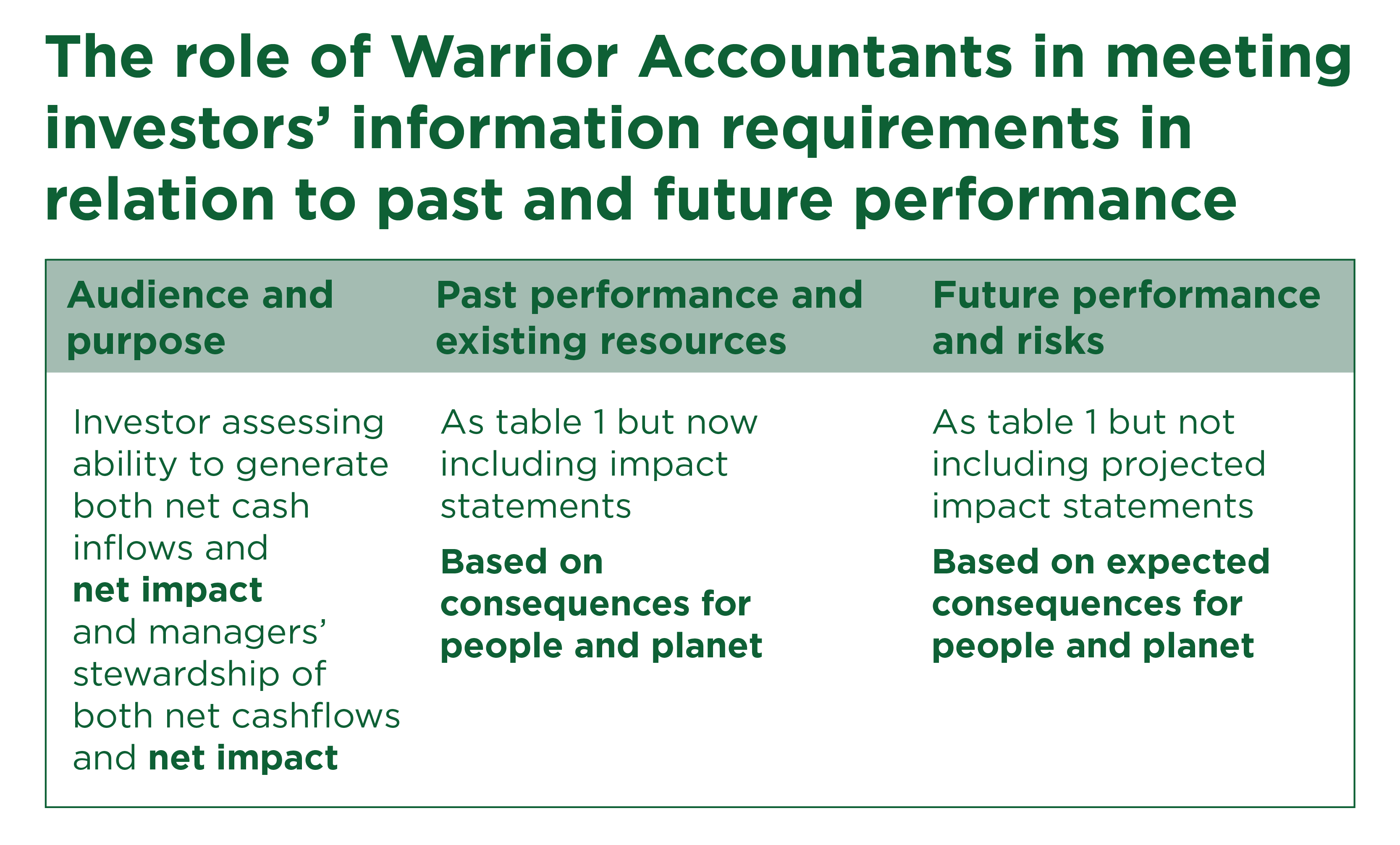

Accounting has an established approach to being clear on the audience and the purpose of accounting information and then on the requirements of that information to be useful. In the enthusiasm for being warrior accountants there is a risk that accountants forget this approach at a time where accountancy has so much to offer the ESG debate. If, as argued in my last article, investors want their decisions to be informed by both expected financial returns and expected impacts, they will need information about the business’ existing resources and its impacts and information on managers’ stewardship of those resources and the impacts. They will also want information on the business’ future financial prospects and future impacts on people’s wellbeing, and risks to the business and to people’s wellbeing. Managers then become responsible for their stewardship of resources for both financial returns and impacts and will have to account for the trade-offs.

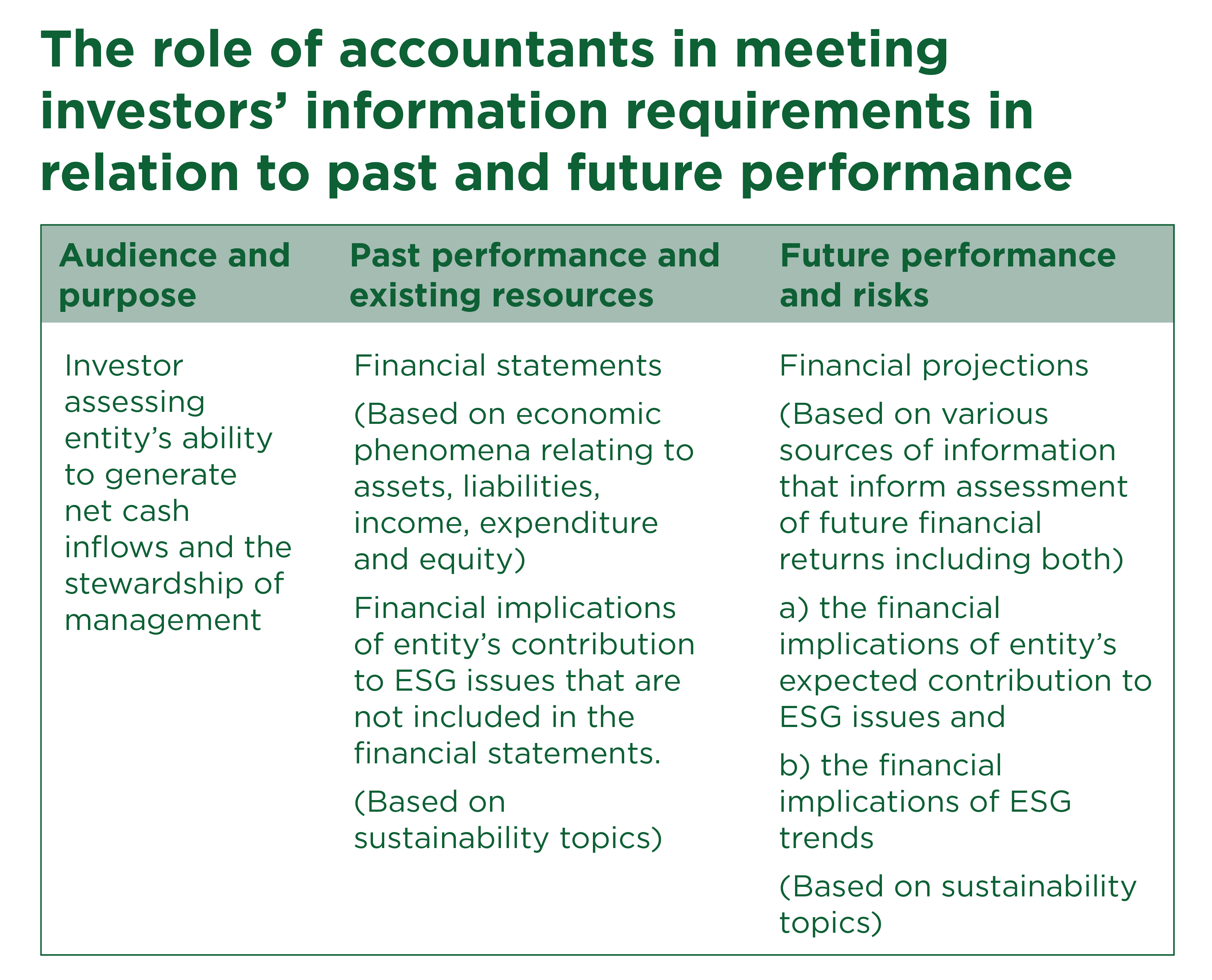

The table below sets out the role of accountants in meeting investors’ information requirements in relation to past and future performance.

ESG is important because it provides information on future prospects and risks to the business. Those risks could be internal, lurking in the existing business or they could be external but both affect future performance and both need managing.

In order to help investors to make assessments on an entity’s ability to generate cashflows, financial accounting addresses two key things:

- the economic resources controlled by the entity and claims against those resources (the balance sheet); and

- performance in managing those resources to generate future cash inflows (the profit and loss account and cashflow statement).

The balance sheet, profit and loss account and cash flow statement have different purposes and are integrated by double entry book-keeping through the company’s equity.

And the accountancy profession is catching up in recognising that ESG risks may have implications for the accounts, for example, on the risks that asset values are overstated. The International Accounting Standards Board has guidance on the effects of climate related matters on financial statements which considers, for example, the need for impairment of existing assets. Fair enough, although Mark Campanale of Carbon Tracker suggests that something like $30tn of assets in the fossil fuel economy will need to be written down.

The warrior accountant has more to do than help develop and standardise ESG. The risks associated with the business’ dependencies on natural, social and human capital, either a dependency on declining environmental resources or, for example, a dependency on wage and working conditions below ILO standards, should also be managed and reported.

The accountancy profession is catching up in recognising that ESG risks may have implications for the accounts

In relation to the financial statements, there is also more to be done in identifying and disclosing potential claims against the business, predominantly because if these claims can be practically avoided, they don’t need to be disclosed. The recently produced report by the Capitals Coalition on the Disclosure of impacts on the Capitals in the Financial Statements addresses this in more detail.

But accountancy still has much more to offer. For an investor interested in impacts, in the contribution of a business to wider wellbeing, ESG would need to be defined and measured in relation to the changes in people’s wellbeing and investors would need a way to assess managers’ stewardship of those impacts.

Warrior accountants should focus on better disclosure of impacts in the accounts. Initially this means a more generous application of existing accounting standards. But it then also means questioning an approach to financial accounting that is not designed to recognise the consequences of businesses operations on the impacts experienced by others because of a business’ operations. If these were integrated with, and recognised in, the accounts, it would affect the bottom line, affect investors’ understanding of how these issues are being managed and on the business’ future prospects. It would affect the enterprise value of the business. (There is a view that if the investor is taking a long-term view then all the issues that are risks to people’s wellbeing will also be financial risks and so be included. I am going to park this for now.)

Impact accounting often accounts for what the impact was over the last year, hopefully the positive and negative impacts determined by those that experience them caused by the enterprise, but nonetheless measuring impact. If we are interested in assessing managers’ stewardship of the impacts – in assessing how effectively they have managed those impacts, increasing positive and reducing negative impact – a measure of impact isn’t enough. We need both the equivalent of a balance sheet and a profit and loss account; an impact balance sheet and an impact profit and loss account.

We need an impact balance sheet and an impact profit and loss account

And if we are interested in driving resource allocation to businesses that generate financial returns and net positive impact we can then go further and integrate the financial statements with these impact accounts. The concern over trade offs between finance and impact is true for many current business models (where returns are being made at the expense of the wellbeing of the people and planet) but that’s the point of creative destruction; new business models will be created by new entrepreneurs that do both.

Financial accounting should inform impact accounting

My last article argued that the separation between investors interested in financial returns and wider societal interests is a false separation, since investors only interested in financial returns do not represent the needs of the maximum number of users, nor of public policy, nor of the stated purpose of those bodies responsible for financial accounting and capital markets. But let us live with that starting point for now, since it drives so much of what is happening.

Focusing on an enterprise’s resources and impacts and management’s stewardship in relation to both resources and impacts means applying the insights that accountancy has developed over the last hundred years or so.

These insights are set out in the Conceptual Framework for Financial Reporting. They are that for information to be useful, that is to inform decisions to provide economic resources to a business, the information needs to be relevant and needs to be faithfully represented. This is summarised below in order to highlight the areas that will need development:

Useful information

The starting point for making decisions is information that can inform those decisions, information that relates to:

- economic resources controlled by the entity (assets) and claims against those resources (liabilities); and

- management’s stewardship of those resources

because this is what drives the generation of net cash flows and financial returns and those financial returns are a proxy for wellbeing. This means ensuring that the balance sheet includes information on all the assets that generate economic benefits including what are (dangerously) called intangible assets.

The new requirement would be to include:

- positive and negative impacts

- management stewardship of those impacts

because these are the consequences of a business’ operations to generate those cashflows for the wellbeing of people and planet.

This means that information must relate as closely as possible to the changes in the wellbeing of people and planet that have been caused by the enterprise. Indicators will need to measure those changes as directly as possible. Measuring outputs, as a proxy for changes in wellbeing is of limited use in making decisions. Two investment opportunities can have the same outputs but result in very different changes in wellbeing. Using accountancy’s approach to determining useful information shows that information based on outputs is less useful.

Relevant

Relevant information is information that is capable of influencing a decision and so this also needs to be material; it needs to matter. This would now mean information that is capable of influencing decisions to provide resources to the entity in an expectation of financial returns and impacts.

In part whether something matters is about considering the number of people experiencing the impacts, the depth of change they experience and the extent to which the change is caused by the enterprise. But it is also about the value of those changes to those experiencing them in the context of the planetary thresholds and social norms. The value to those that experience the impacts. Not the value to those that create them. Only then can we assess what matters.

Current accounting standards also recognise that whether economic phenomena are material is influenced by existence and outcome uncertainty, but that high levels of existence and outcome uncertainty are not a bar to deciding that information does matter and should be disclosed. Disclosing information on impacts may have have inherently higher levels of existence and outcome uncertainty, especially when considering the share of the impact that can be attributed to an entity, but again this is not a bar to disclosure.

Faithful representation

Relevance is not enough for information to be useful in those decisions. Information must also be faithfully represented. The requirements for faithful representation include being represented in monetary units and for the measurement being sufficiently free from error. For some, representing people’s wellbeing in monetary units is difficult, but the reality is that, in making investment decisions between different opportunities, different sets of impacts, positive and negative, would be experienced by different people and yet a choice is made. Implicitly, a comparison between different impacts and the cost of the investment will be made. The investor is going to need to know how managers have made these choices, comparing these different sets of impacts in relation to the resources they have used. This means quantifying the relative importance of these impacts using monetary units. What is called measurement in financial accounting and valuation in impact accounting is fundamental to transparency in management decision making and ability of investors to assess managers stewardship. It is fundamental to making information useful, and it also helps assess materiality. Done well it would also ensure that, for example, negative impacts above thresholds set by planetary boundaries and social norms would have very high relative values.

Most ESG and impact information does not include valuation, despite developments in the Capitals Coalition, and SVI which have focused on measuring and valuing impacts in ways that provide users with assurance that they can use the information. Apparently, this is too hard. But again, financial accounting recognises measurement uncertainty and this is not a bar to disclosure. Yes, there comes a point when information is best placed in notes to the financial accounts, and a point where measurement, existence and outcome uncertainty reach the point disclosure is not useful, but challenges in valuation are not a barrier per se. Excluding valuation limits the usefulness of information for decision making and so limits our ability to assess managers’ decisions in relation to reducing negative and increasing positive impact. Impact valuation is what the EU Life Transparent project, run by Value Balancing Alliance, Capitals Coalition and WBCSD, has been working on. Kering, the luxury good brand (eg Gucci) and a growing number of other companies, including water utilities, food & beverage companies and those in the chemical and pharmaceutical sectors, are regularly producing social and/or environmental profit and loss accounts.

Critically, the information that goes into the financial statements does not need to be comparable. Comparability enhances the value of information but it is not a requirement! This may seem surprising, but comparability of financial statements arises from consistent application of accounting standards supported by audit, not from consistency of the inputs. Compare this with the current enthusiasm for standardising sustainability metrics as an input to a sustainability report – and weep.

Warrior accountants will also need to put pressure on the accountancy profession and on the standard setters

The argument that sustainability topics are different and more complex than financial ‘topics’, and that therefore consistent and standardised metrics are necessary, constrains innovation in business models that drive sustainability outcomes and wellbeing but need different metrics. Valuation solves this problem and provides investors with information on management’s inevitable trade-offs between different impacts. The financial ecosystem welcomes new enterprises, new business models and new ways of creating value which require new metrics and all within an accounting system that still provides comparability. Metrics become standardised as new business models develop and succeed rather than being imposed.

Of course, it is understandable that society would want some information from all businesses, irrespective of whether it is material to investors but because it is material to society, and that this might be based on standardised metrics. But this is not the same as information that can be used to assess managers’ decisions and sustainability performance.

Assets, liabilities, income, expenditure and equity

The financial statements consist of the balance sheet, with the assets, liabilities and equity; the resources and claims on the entity and the profit and loss account with the income and expenditure and any profit or loss being added or deducted from equity. Impact accounting will need to develop comparable statements; a statement of the resources controlled and dependent on and a statement showing how changes in these relate to changes in people’s wellbeing.

These then are the areas where our warrior accountants should focus: pushing ESG towards measuring changes in wellbeing and towards valuation; helping impact accounting focus on decision making and risk and on the level of rigour that is appropriate for those decisions; ensuring that the balance sheet provides a better picture of the value of a business; relentlessly explaining that accounting information is not designed to meet social science tests, the tests so often used to argue that impact valuation and outcome measurement are too hard, but on providing useful information, on relevance and faithful representation. All of which will bring financial accounting and sustainability reporting, and the people working in these areas, closer together.

While it is the directors who are responsible for an entity’s financial statements, it is the accountants that prepare these accounts for the directors. There is plenty of scope to start to include aspects of an entity’s impacts in the accounts, but it will be warrior accountants who can push for more disclosure, whether as accountants or in wider roles in C-suite or as board members. Warrior accountants will also need to put pressure on the accountancy profession and on the standard setters, after all both the Financial Accounting Standards Board and the International Accounting Standards Board are run by accountants.

We urgently need a rethink of the information needs of the generalised investor that underpins the accounting edifice. But then apply the same approach to useful information to these updated needs. Accountancy is too boring for most people to engage with. What I have heard being called the dark matter of our economic system is also the smooth-running engine in a car – for most of us it seems to work so why think about it. Once accountants realise that it isn’t working, and that we need to tame the lion, perhaps then warrior accountants can help accountancy save the world.

- Jeremy Nicholls is a director and one of the founders of Social Value International and an ambassador to the Capitals Coalition.

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.

[1] Although there is no single agreed definition for ESG, it generally relates to those factors or issues that might affect financial returns and so are useful in informing investment decisions.