Institutional investors fastest-growing source of capital for impact investment managers, new GIIN survey reveals

Increased capital flows from pension funds and insurance companies show “expanding appeal” of impact investing – but investors favour high-income countries over Global South in face of economic volatility, latest GIIN research shows.

Institutional investors have become the fastest-growing source of capital for impact investment managers, one of the largest surveys of impact investors to date reveals.

The research published this week by the Global Impact Investing Network (GIIN) is based on responses from more than 300 impact investors from around the world, including investment managers, foundations, development finance institutions, pension funds and insurance companies among others.

The survey shows that impact assets under management have grown at a compound annual growth rate of 18% between 2017 and 2022 – investors in the sample managed an aggregated US$213bn in 2022, up from US$95bn five years before.

That growth is in part led by increased amounts of capital flowing from institutional investors towards impact strategies, according to the research.

Together, pension funds and insurance companies grew the capital they allocate to impact strategies at a compound annual growth rate of 32% between 2017 and 2022 – representing the fastest-growing source of funding for impact investment managers. They are followed by sovereign wealth funds, which grew their allocation to impact strategies at a compound annual growth rate of 22% over the same period.

These increased flows of institutional capital towards impact suggest “a shift in investment approaches and the dynamics of financial markets”, according to the report.

The expanding appeal of impact investing is evident as investors are witnessing substantial increases in capital inflows from major institutional investors

Pension funds are currently the largest single source of capital for impact investment managers, representing 20% of capital flows towards impact funds, followed by family offices (15%), development finance institutions (14%) and insurance companies (7%), according to the research.

Amit Bouri, CEO & co-founder of the GIIN, said: “The expanding appeal of impact investing is evident as investors are witnessing substantial increases in capital inflows from major institutional investors, including pension funds and insurance companies.”

Where the money goes

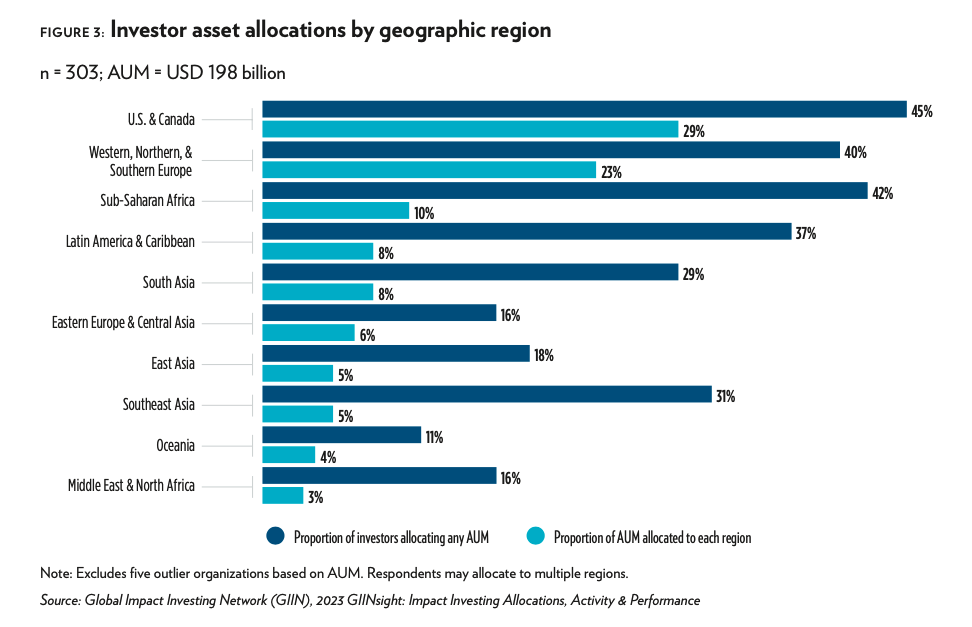

The research shows that investors in the sample deploy more than half of their capital in high-income countries – US and Canada attract 29% of impact assets under management, followed by western, northern and southern Europe (23%).

Those were also the two regions where amounts of capital deployed have been growing fastest, seeing compound annual growth rates of 53% and 33% respectively.

Growth in the Global South has been more subdued – capital allocated to sub-Saharan Africa and South Asia only grew at a compound annual growth rate of 14% and 15%, respectively.

Steven Evers, director of Triple Jump, an impact investment firm focused on emerging markets, said it was “worrying” to see that most of the growth in impact capital allocation was going towards high-income countries rather than Global South countries, which “need it the most”. “We need to renew the focus on that,” he added.

Dean Hand, chief research officer at the GIIN, said there may be a “flight to safety” from investors in the face of economic volatility in recent years – and Global South investments tend to be perceived as more risky.

Because they have a mandate to optimise financial returns for their asset owners, institutional investors in particular are likely to be more risk-averse than others – and Evers said he estimates they will be more likely to allocate their capital to high-income countries.

In emerging markets, without blended finance it is really tough to attract private investors at scale

Agustín Vitórica, co-founder and co-CEO of Spanish impact investment firm GAWA capital, said blended finance (where capital that is risk-tolerant or can accept lower returns is brought into a deal to de-risk the transaction and attract commercial investors) was a crucial tool to enable the flow of private capital towards emerging markets – indeed, some of the requirements on risk and returns for institutional investors are not compatible with many investments in Global South countries.

- Read more: What is blended finance?

The survey shows for example that impact investors that target financial returns below market-rate allocate a third of their assets under management to sub-Saharan Africa; on the contrary, impact investors targeting market-rate returns allocate just 6% of their capital to the region.

“For those of us who are investing in emerging markets, without blended finance it is really tough to attract private investors at scale,” Vitórica said.

Listed assets

Investor allocations to impact have increased across all asset classes, the survey shows. While the greatest proportion of capital was allocated through private equity (26%), the report shows a significant increase in impact investments in public markets: public equity investments increased at a compound annual growth rate of 14%, and investments in public debt, notably, grew at a compound annual growth rate of 101%.

Public equity and public debt together attract 28% of impact investors’ assets under management, the survey shows.

Bouri said while impact investing originally started with private assets, “we can never address something at a systemic level with just focusing on the impact of private assets… We actually have to think about how to activate assets across the entire portfolio.”

There was demand from investors who wanted to scale their impact allocation beyond the private market, he explained, and the GIIN had worked with stakeholders to define what a credible impact investing strategy looks like in listed equities, applying its core impact investing principles to public markets.

“The structure is similar to what you'd see in a private equity fund, the means and tools and the holding periods are obviously quite different,” Bouri said.

Top picture: Amit Bouri at the GIIN Forum 2022 in the Hague, courtesy of the GIIN.

Thanks for reading our stories. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.