How to unlock VCs’ full impact potential

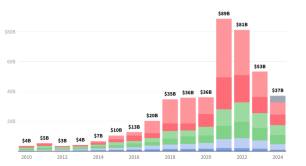

If you take the latest numbers from the GIIN, impact investing has long moved from niche to mainstream. But for many in the impact space, reality feels very different at the moment. “Where did social go?” was the title of a recent cri de cœur by a well-known European impact VC, Johannes Weber of Ananda Impact Ventures, who made the case that “investing in people is just as vital as protecting the planet”. While many have obviously fallen in love with climate-tech – and, as Weber pointed out (drawing upon Dealroom data), invested US$350bn in this space over the past five years – only a meagre US$12bn went to social equality solutions. Why is that? And more importantly, how can we change this?

“For VCs, social investment is much more complex than climate-tech,” confirmed Inès Mertens (pictured), impact funds lead at impact investing network Impact Europe, in a multifaceted session about how to unlock VCs’ full impact potential. Many myths and truths were unearthed during this ‘Impact Fire Talk’ organised by European impact finance advisor FASE. Francois de Borchgrave, a seasoned investor and partner at Impact Expansion and KOIS, hit the nail right on the head. “VC has this Silicon Valley image of quick exits and high multiples. But in reality, many traditional VCs focus on slower-growing companies and sometimes hold them for 10 years or even longer,” he said.

“For VCs, social investment is much more complex than climate-tech,” confirmed Inès Mertens (pictured), impact funds lead at impact investing network Impact Europe, in a multifaceted session about how to unlock VCs’ full impact potential. Many myths and truths were unearthed during this ‘Impact Fire Talk’ organised by European impact finance advisor FASE. Francois de Borchgrave, a seasoned investor and partner at Impact Expansion and KOIS, hit the nail right on the head. “VC has this Silicon Valley image of quick exits and high multiples. But in reality, many traditional VCs focus on slower-growing companies and sometimes hold them for 10 years or even longer,” he said.

A related VC myth got busted by Espen Daae (pictured), investment chief social impact at Ferd, a single-family office and highly experienced impact investor in the Nordics. “If you look at real VC returns over a longer period, the average is rather 13% pa, not the 30% pa that VCs typically sell,” he said. “And once you’re ok with achieving these 13% in the impact space, you have a wide array of companies and different types of exits you can target.”

A related VC myth got busted by Espen Daae (pictured), investment chief social impact at Ferd, a single-family office and highly experienced impact investor in the Nordics. “If you look at real VC returns over a longer period, the average is rather 13% pa, not the 30% pa that VCs typically sell,” he said. “And once you’re ok with achieving these 13% in the impact space, you have a wide array of companies and different types of exits you can target.”

Dr Markus Freiburg went on to make a reality check on the concept of ‘social innovation’. “The term is often misunderstood,” the co-founder of FASE and the European Catalytic Impact Investing Fund (ECIIF) pointed out. Originally coined by Ashoka founder Bill Drayton, social innovation goes in parallel to technological innovation but in contrast to its well-known tech sibling, it “needs more patient models, takes longer to build, and isn’t necessarily poised for a sale of the company”.

Let’s reframe the narrative for impact investing together and position Europe differently. It’s a decisive moment in history and a big chance to move capital to social innovation

In recent years, there has also been a reinvention of models on the receiving end of capital. Legal structures such as cooperatives, steward ownership, or even an independent model planned by the new German government are designed to be closer to the realities of impact investees. The idea behind these is to enable the companies to protect their values regarding the environment, society and their employees directly within their DNA, and even keeping ownership entirely within the company. As a result, finance has to follow suit and become much more flexible and innovative.

One hot innovative finance trend in the past 10+ years has been the use of catalytic capital in blended finance structures. Still today, catalytic capital providers such as foundations, large family offices, and development agencies are a much sought-after but rare breed of funders. Catalytic capital has an enabling nature as it generally accepts more risk, is ready to be concessional regarding financial returns, tends to be more patient, and “doesn’t chase quick exits”, as Mertens explained. But although this secret sauce has been quite successful in derisking and mobilising more commercial capital for social innovations, the recent cuts in official development assistance (ODA) and pressures on US-based foundations to justify their tax-free status will probably make it even scarcer.

From myth-busting to solutions orientation

So how to ensure that social innovations get high on the investors’ agendas? What’s the pathway to unlocking impact VCs’ full potential?

One answer is to expand the usual VC investment horizon by including attractive, non-exit-oriented impact ventures. For example, the ECIIF uses a public guarantee called InvestEU to “revolutionise the VC model by financing more patient business models too”, as Freiburg described the rationale behind his fund. Such a guarantee, in this case provided by the European Investment Fund, eases the pressure that every portfolio company has to perform like a rockstar – a typical requirement in traditional VC. On top of this, investors can benefit from downside protection, which is a powerful argument in a macroeconomic environment that gets more volatile by the day. “Now is a great opportunity for investors to take a stand,” Freiburg (pictured) believes. “Many social challenges are massively underfunded, and if you use catalytic solutions smartly, different types of investors can contribute.”

One answer is to expand the usual VC investment horizon by including attractive, non-exit-oriented impact ventures. For example, the ECIIF uses a public guarantee called InvestEU to “revolutionise the VC model by financing more patient business models too”, as Freiburg described the rationale behind his fund. Such a guarantee, in this case provided by the European Investment Fund, eases the pressure that every portfolio company has to perform like a rockstar – a typical requirement in traditional VC. On top of this, investors can benefit from downside protection, which is a powerful argument in a macroeconomic environment that gets more volatile by the day. “Now is a great opportunity for investors to take a stand,” Freiburg (pictured) believes. “Many social challenges are massively underfunded, and if you use catalytic solutions smartly, different types of investors can contribute.”

Daae is equally convinced that innovative finance can make a dent in turbulent times. “There is a lot of innovation, from results-based financing to redeemable equity to impact-linked finance,” he stressed. As an example, Ferd recently engaged in a Swedish outcomes fund that invests in social outcomes contracts, and Daae expects to see more innovations like these in the market that “hopefully will achieve tangible success.”

- Read more in our Impact 101: What is an outcomes fund?

Asked how investors can make a difference for Europe’s competitiveness in turbulent times, de Borchgrave (pictured) said that this is exactly why European impact VCs invest at their doorsteps: “We support European companies whose raison d’etre is having a positive impact on Europe’s society, from easing the lives of disabled people to transitioning to energy efficiency to better mental healthcare. But we’re also trying to invest in companies that we can internationalise within and beyond Europe.” For him, improving the lives of European citizens and building the champions of the future definitely go hand in hand.

Asked how investors can make a difference for Europe’s competitiveness in turbulent times, de Borchgrave (pictured) said that this is exactly why European impact VCs invest at their doorsteps: “We support European companies whose raison d’etre is having a positive impact on Europe’s society, from easing the lives of disabled people to transitioning to energy efficiency to better mental healthcare. But we’re also trying to invest in companies that we can internationalise within and beyond Europe.” For him, improving the lives of European citizens and building the champions of the future definitely go hand in hand.

Europe’s unique opportunity

In an Impact Fire Talk full of European impact VCs and experts, it’s probably no surprise to feel a tangible enthusiasm for Europe to use the momentum and focus on creating a sustainable society. “While the US is on an entirely different trajectory, I think Europe has a unique opportunity to double down on what matters, attract more talent and strong companies, and create its own markets to support these companies,” Daae said, summarising the sentiment in the room.

While the US is on an entirely different trajectory, Europe has a unique opportunity to double down on what matters, attract more talent and strong companies, and create its own markets to support these companies

As a tangible example, he shared Ferd’s and KOIS’s early investments in Auticon, a German social enterprise that uses the unique strengths of people on the autism spectrum as IT consultants and has become a global impact champion operating across 15 countries today. But successes like these don’t emerge from a void. “Cool journeys like these come from hard work and flexible investing over a long period of time. This is the unique competence that European investors can leverage. And this opportunity just got greater with what’s happening in the US,” he added.

- Read more about Auticon: Advantage autism: the social business that champions neurodiversity at work

Freiburg’s final call to action followed the same tune. “Let’s reframe the narrative for impact investing together and position Europe differently”, he said. “It’s a decisive moment in history and a big chance to move capital to social innovation. I don’t want to be asked by my children in 30 years why I didn’t do more.”

Learn more about the takeaways from this and the other Impact Fire Talks: check out the summaries and additional readings on the topics here.

Header image created with Freepik AI Suite

This feature remains free to read thanks to the support of our partner, FASE. Find out more about our partnerships

| Ready to invest in independent, solutions-based journalism?

Our paying members get unrestricted access to all our content, while helping to sustain our journalism. Plus, we’re an independently owned social enterprise, so joining our mission means you’re investing in the social economy. |