Global VC investments in impact startups fall to lowest level since 2017

Investments in impact startups decline for a fourth year in a row despite a healthy growth in the broader VC market, as investors shift their focus to defence and AI – and leave some impact areas sorely underfunded.

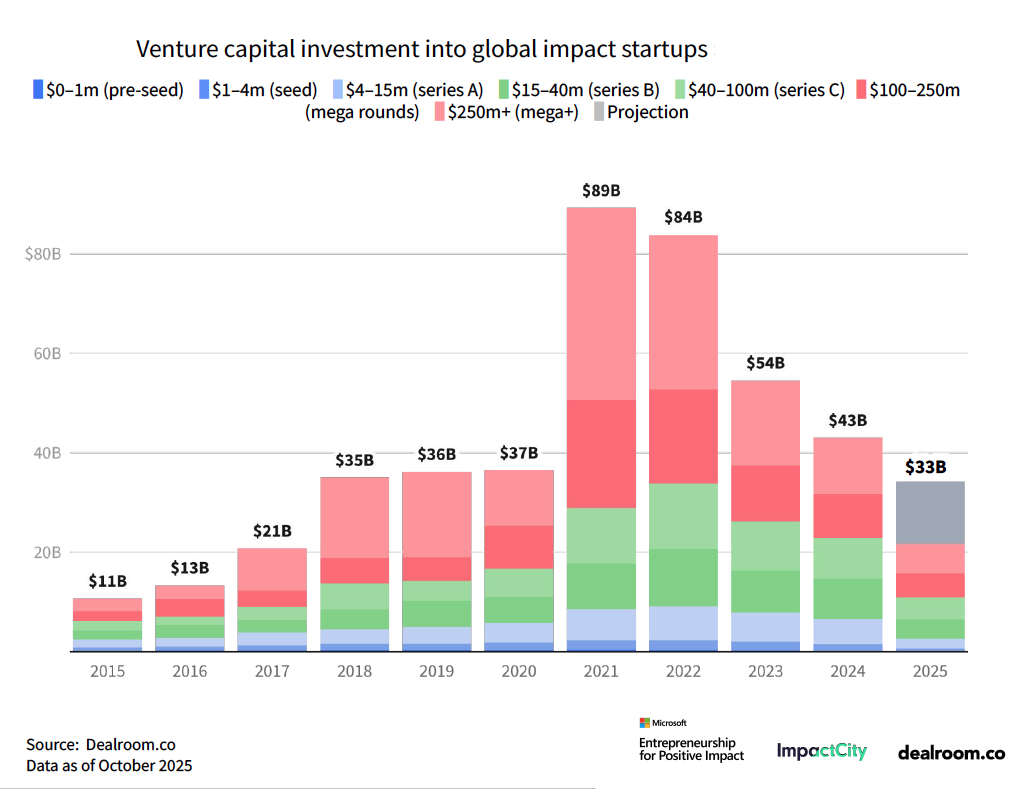

Venture capital investments in impact startups are expected to fall to US$33bn this year – their lowest level since 2017, according to Dealroom’s State of Impact 2025 report, unveiled yesterday at ImpactFest in the Hague.

This follows a sustained decline in VC investments in impact startups over the past four years. Impact startups raised 24% less investment this year than in 2024 – and 63% less than 2021’s record high of US$89bn.

The study, published by startup data platform Dealroom, ImpactCity The Hague and Microsoft Entrepreneurship for Positive Impact, is based on data from 16,000 impact startups from around the world, listed on Dealroom’s Impact Database. More than half of impact startups on the database are based in Europe, 27% in North America, 11% in Asia and 7% in the rest of the world.

Dealroom defines an impact startup as “a company that addresses one or more UN Sustainable Development Goals at the core of its business and has the potential to scale”. Startups included on the Impact Database range from AI biodiversity startup Synature and alternative protein company Meati to electric carmakers Tesla and BYD.

Speaking at ImpactFest on Thursday, Eglantine Dupuy, research associate at Dealroom, said 2021 was an outlier – in terms of all VC investments – as broader economic circumstances created a general VC investment frenzy.

But, while last year’s 20% drop in VC investments in impact startups came amid a broader decline in all VC investments (albeit softer at -4%), this year’s fall is happening despite a thriving sector: global VC investments are projected to grow by 33% this year, with artificial intelligence attracting 84% more VC funding than in 2024, and investment in defence startups raising more than double. Dupuy noted that global growth was driven in particular by a number of especially large deals in AI and defence.

Impact unicorns

Eight impact startups became “unicorns” so far in 2025 (meaning they’ve reached a US$1bn valuation), including companies working on nuclear energy, battery systems and telemedicine, according to Dealroom data. This shows a slowdown compared with the 2018-2022 period, over which more than 200 impact unions were “minted”. In total, more than 300 impact startups became unicorns since 2000.

This year’s volumes are still three times higher than in 2015, when impact startups raised US$11bn. The enterprise value of impact startups (the amount it would cost for a buyer to take over the company) has risen steadily since 2022, now totalling US$3.6tn, which is 28 times more than ten years ago. But this is still tiny compared with the broader VC sector, Dupuy said: “To put things into perspective, when we look at all companies that are VC backed, they're worth over US$46tn in terms of VC funding.”

Uneven

The most targeted SDGs are Climate Action and Affordable and Clean Energy, respectively attracting US$234bn and US$123bn in VC investment between 2019 and 2025. The two sectors scale well and fit a traditional VC model, the researchers point out, unlike the category of Peace, Justice and Strong Institutions where innovations are harder to monetise and more reliant on public policy and public funding, and have attracted just US$2bn over the same period.

Dupuy said overall, investments tended to go to companies that had cross-industry applications – for example, sustainable materials and supply-chain resilience. Meanwhile, investors are losing interest in sectors that are essential but already underfunded, such as food security startups (which raised US$1.9bn, half as much capital as last year), or water – sustainable “blue tech” companies raised a projected US$1bn, down to 2020 levels.

Circular economy businesses, which were successful pre-pandemic until 2022, are projected to attract less than US$300bn in 2025 – the lowest in more than 10 years. Circular economy businesses focus on designing out waste and pollution by circulating products and materials through, for example, reuse and recycling, rather than the traditional 'take, make and dispose' business model.

The re-prioritisation of VC funding away from impact startups indicates a broader shift in global priorities, as conflicts, economic challenges, new trade barriers and an AI race shift investments towards defence, energy and supply chain resilience and emerging technologies.

The under-funding of some crucial areas is particularly striking when seen alongside non-impact sectors. Researchers highlight the discrepancy between investments in “peace tech” – startups developing tech solutions for a more peaceful world, which have a combined enterprise value of US$2.8bn – and “defence tech” – startups that develop technology with military applications, which are collectively worth US$693bn.

Irene Samwel, programme manager at Impact City, said: “Peace tech is really underinvested, and I think it’s important, especially for us as the city of peace and justice here in the Hague to keep facilitating options for them to keep growing”.

Shawn Guttman, founder of Didi, which uses AI to track public conversations for clients focused on peace-building, told Pioneers Post that raising investment was difficult in part because the concept of “peace tech” itself was new: “This idea that you can create technological tools to help people make peace, as a for-profit business model… It’s been hard raising money within that context.”

Geography

“AI for good” was a growing sector, Dupuy said, with AI companies targeting the SDGs raising US$4.4bn in 2025 alone and mostly focusing on climate and energy.

Nearly 60% of impact VC investment was raised by startups in North America, with Europe only attracting 28% and Asia 10%. Only two years ago, American startups accounted for just 30% of impact VC investments, with Europe attracting 40% and Asia 27%. Dupuy said that some large investments in nuclear startups – an expensive technology – in the US could explain North America’s leading position.

But Europe remains the most “impact-oriented” continent: investments in impact startups account for 15% of total VC investments in Europe, versus only 7% in North America and 4% in Asia.

Top image: iStock.com/narvo vexar

| Ready to invest in independent, solutions-based journalism?

Our paying members get unrestricted access to all our content, while helping to sustain our journalism. Plus, we’re an independently owned social enterprise, so joining our mission means you’re investing in the social economy. |