US foundation bucks trend with impact investment transparency commitment

Measuring the social impact of investments is notoriously tough; comparing the good that different investments achieve is even tougher. But here at NPC, working with US impact investment pioneers Charly and Lisa Kleissner, we’ve tried to start doing just this.

The emerging impact investment field faces numerous barrier to growth, none more so than transparency over returns. It is hard to encourage newcomers into the field when there is so little information about the gains (or losses) that can be made—both financial and social.

However, Charly & Lisa Kleissner are really bucking the trend. They have committed to being as transparent as possible across all the processes, policies and returns of their KL Felicitas Foundation (KLF), which is 100% invested for social and environmental impact across its entire asset base. They first published the financial performance of the public portion of their portfolio in 2013, to show that investors could achieve market-competitive returns whilst pursuing social and environmental objectives.

This year we were given the challenge of analysing the social impact of their investment portfolio.

This was never going to be easy. KLF has a diverse portfolio of 43 investments, blending together direct investments in companies and holdings in funds, while also ranging across asset classes, sectors and geographies.

Of the more than 40 companies and funds in their portfolio under analysis, the Kleissners’ investments have contributed to a range of impacts, including a change in energy consumption behaviour for over 20,000 people through their investment in Biolite, and helping Hawaii become more self sufficient and cut down on imports by supporting MA’O organic farms.

One of the challenges was around data collection: some investments offered quite a lot, some much less. But even when we had analysed the impact of each, another question remained. How do you compare the social return achieved by such different investments? How, for example, can you compare an investment changing the lives of 600,000 farmers a year with another which is helping reduce CO2 omissions by 10,000 tonnes?

To try and answer this, we developed NPC’s Impact Assurance Classification, a framework which allows us to compare impact by assessing the quality and robustness of impact data produced by investees. This acts as a proxy for the level of impact: it is based on our belief that a developed, intentional impact measurement process is likely to be associated with a greater focus on impact, and by extension an increased probability of impact.

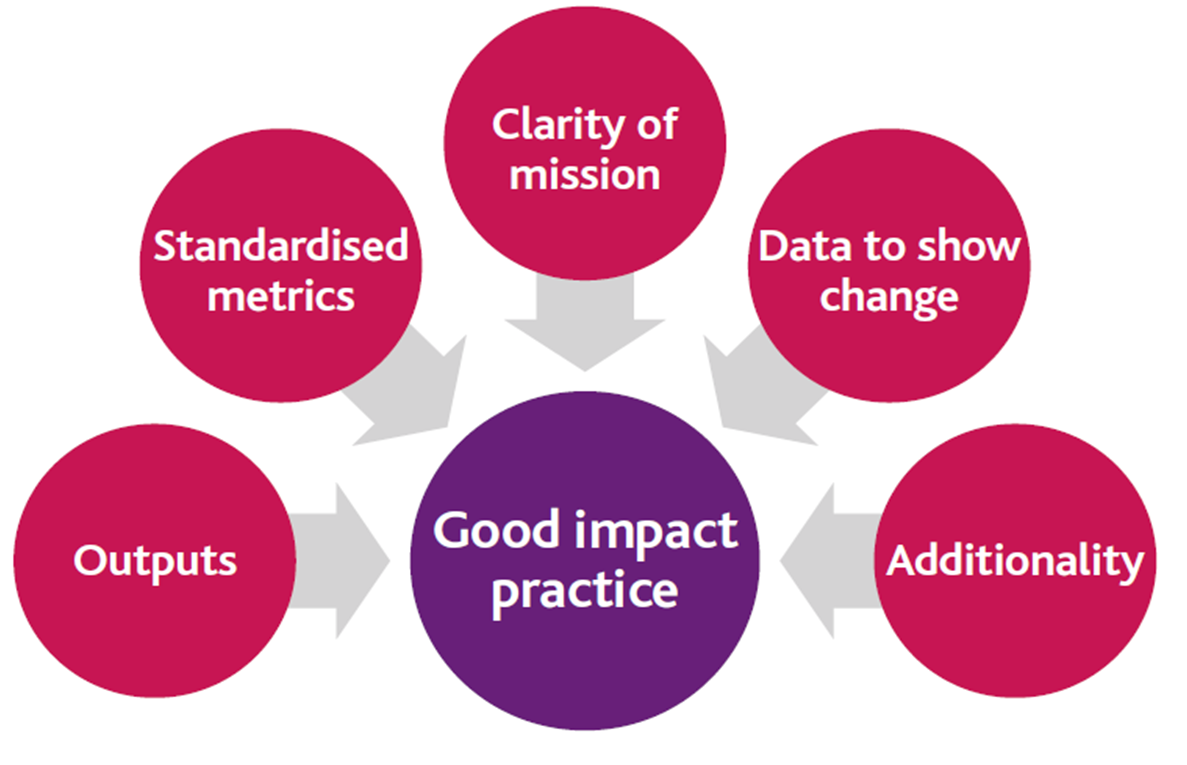

The score given to each investment is based on five components of impact practice—outputs, standardised metrics, outcomes, clarity of mission, data to show change and additionality—which can then be compared, whatever the asset class, whatever the sector, whatever the geography. And there were some interesting conclusions. On the whole, those investments which are best-established have the higher impact practice scores. Funds scored higher than companies, and food and agriculture was the strongest sector. There were also some outliers—one fund, for example, which was set up in 2006 with weak impact practices. It is these outliers which need to be explored in more detail.

Our report also looked at the overall support that came with the Kleissners’ investment in each company or fund. In many cases, and in common with other impact investors, they don’t just provide investment, but often hands-on support and strategic advice as well. They have encouraged other investors to follow their lead, and even made grants to complement their loans. We termed this element of impact ‘Investor Plus’ to match the similar terminology of ‘Funder Plus’ in the grant-making world.

Initial feedback from experts in the field has been positive on both the new framework and the Investor Plus model. We're not there yet, but we look forward to the day when impact practice scores and investor plus ratings can be compared to financial return data (still elusive amongst private equity type investments) across a whole portfolio. If other investors are to be tempted into the impact market, clarity over financial and social returns is key for individuals or institutions alike.

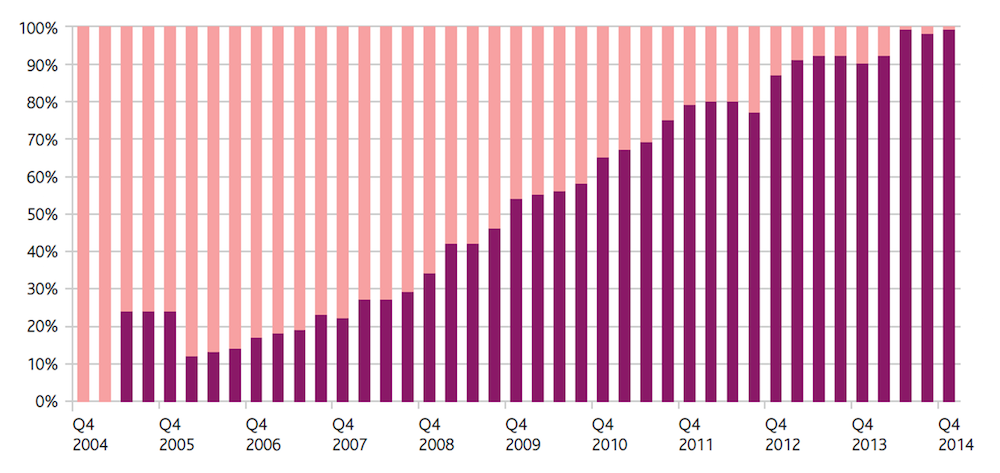

Graph demonstrating percentage of KLF's portfolio invested for impact

It has taken the Kleissners a decade to build this portfolio. As of December 2014 their portfolio was 99.5% invested for impact. But crucially they believe it won’t take others as long. This is in part due to the overall growth in the market—but Charly and Lisa Kleissner deserve credit too. There’s little doubt that their own transparency makes a significant contribution.

Photo credit: Brad Hagan