Spain’s impact investments reach €2.3bn, reveals new research

The latest figures for the size of Spain's impact investment market are a tenfold increase in funds previously identified. They were revealed this week at the annual conference of the Spain National Advisory Board on Impact Investment held online and hosted at CaixaForum in Madrid.

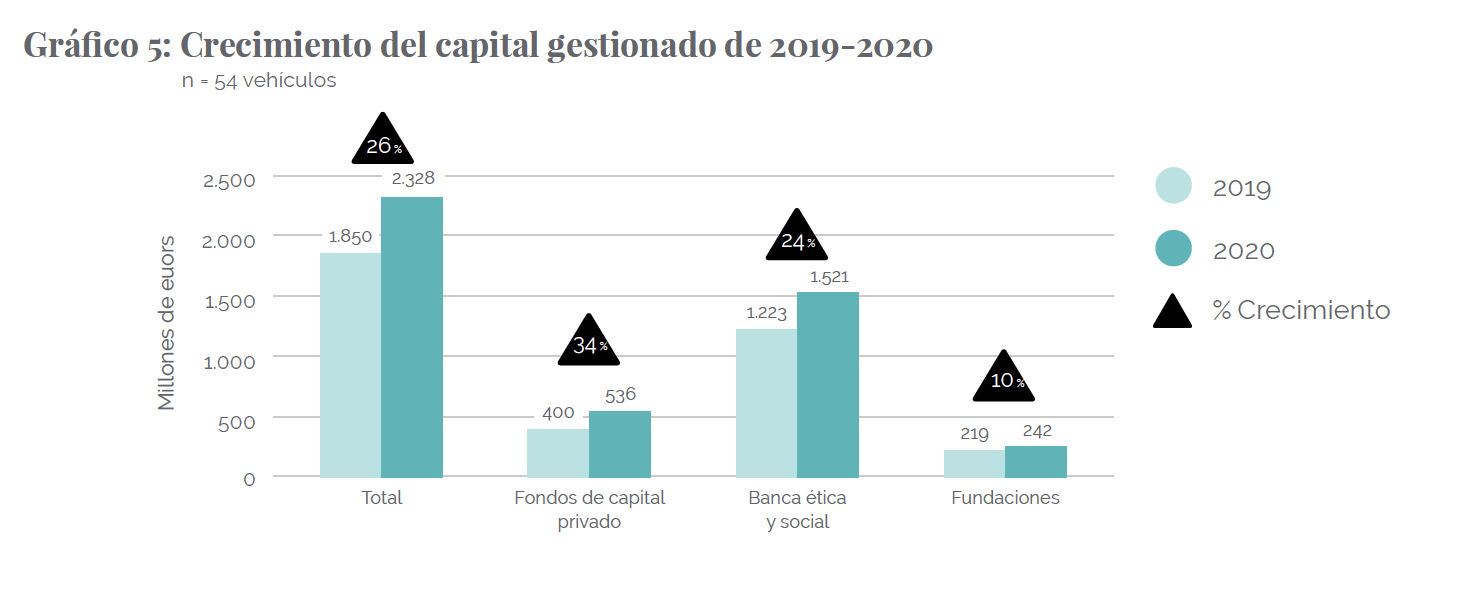

The impact investment market in Spain reached a total of €2.3bn under management in 2020, a 26% growth on the previous year – and a tenfold increase in impact investments identified in earlier research.

The latest figures were revealed this week at the annual conference of the Spain National Advisory Board on Impact Investment (SpainNAB) held online and hosted at CaixaForum in Madrid.

When Spain joined the Global Steering Group for Impact Investment (GSG) in June 2019, research for the SpainNAB had identified just €90m euros in impact investments during 2018. Then in September 2020, at an annual conference that had been delayed by the Covid-19 pandemic, the SpainNAB celebrated an “exponential increase” in impact investments to €229m for 2019.

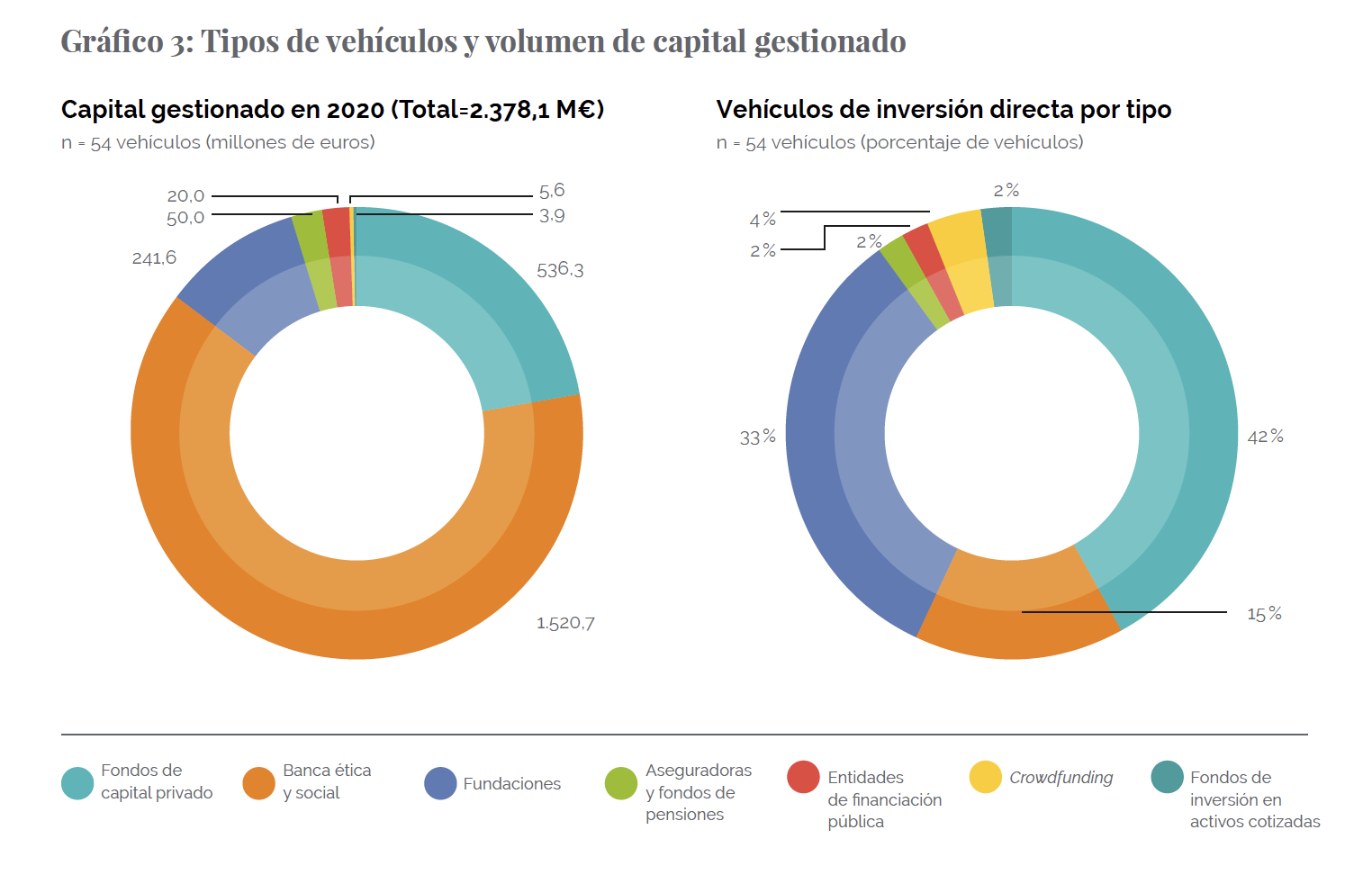

The new figures for 2020 have increased by a multiple of ten because of a radical change in the methodology. Past research identified only private capital in impact investments. The new research, La Inversión de Impacto en España: Oferta de capital, segmentación y características, carried out by the Esade Center for Social impact in Barcelona, has broadened the field to include as many different types of investors as possible.

Speaking at the event on 14 June 2021, Juan Bernal, president of the SpainNAB and director general of CaixaBank Asset Management, said: “During these first two years of the SpainNAB we have maintained the same vision and hope to propel forward impact investment in our country and it must contribute to us emerging from the pandemic with a society that is more just and resilient.”

The increase in impact investment in Spain from 2019 to 2020. The columns (left to right) indicate the total under management, private capital, social and ethical banks, and foundations. Graphic from La Inversión de Impacto en España: Oferta de capital, segmentación y características

In the introduction to the report, Jose Luis Ruiz de Munian, executive director of the SpainNAB, and Lisa Hehenberger, director of Esade Center for Social Impact, wrote: “To boost the impact investment market in our country, we need to understand in depth the supply of capital, the different actors that compose it and the characteristics that define their strategies.”

They added that the new approach would help to harmonise figures for impact investment across all members of the GSG and increase the weight of impact investment within the European Union.

Impact investors and investment vehicles in Spain in 2020. The colours represent (left to right) private capital, ethical and social banks, foundations, insurance and pension funds, public funds, crowdfunding, and mutual funds. Graphic from La Inversión de Impacto en España: Oferta de capital, segmentación y características

The research found that almost 50% of the investors named the environment as one of their main focuses. This was the most common cause, followed by people living in poverty, unemployed people, women and disabled people.

Spain’s impact investment sector expects to continue growing at a rapid rate during 2021, according to the report.

- Camino al Impacto - Juntos hacia un nuevo tiempo took place from 14-17 June 2021.

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.