Beyond VC: How can Europe get fit for an impactful future?

Venture capital isn’t always the best option to back impact startups, especially as the approach is coming under increasing criticism of late, says Dr Markus Freiburg of impact advisor FASE. He flags a new fund which, he believes, could help finance a new, innovation-driven impact middle market that is fit for Europe’s future.

Venture capital isn’t always the best option to back impact startups, especially as the approach is coming under increasing criticism of late, says Dr Markus Freiburg of impact advisor FASE. He flags a new fund which, he believes, could help finance a new, innovation-driven impact middle market that is fit for Europe’s future.

For a long time, venture capital (VC) has been hailed as a great value creator, generator of jobs and funder of innovations. Lately, however, the classic VC mindset, in which a small portion of the portfolio generates the lion’s share of returns at full speed, has been coming under heavy criticism. Scaling at any cost? “No thanks”, an increasing number of voices are saying. This leaves an important question: how else can we close the estimated European social enterprise financing gap of up to €1.4bn a year?

In the impact sector, where sustainable growth and societal value creation are at the heart of all activities (or at least should be), new thinking is emerging, also fueled by the “big crunch” in public development aid. More patient capital, yes, please, but how? Evergreen funds, okay, but are investors actually fine with that? Where are the capital providers who still pursue additionality? And for which impact companies is turbo-scaling really suitable?

Don’t get us wrong: VC has an important role to play in the impact sector – just not for everyone. High-impact ventures, whose impact theme and business model require less turbo and more staying power, can easily fall through the cracks. If you have an unusual legal form, such as a registered association, steward ownership or a cooperative, the chances of successfully schmoozing with an impact VC are rather slim. Felix Schäfer from Bürgerwerke eG (pictured), a German impact venture with the vision of a renewable, regional and independent energy future in the hands of citizen cooperatives, has experienced this first-hand. His credo: “Cooperatives need good access to growth capital to realise their full potential for a sustainable economy.”

Don’t get us wrong: VC has an important role to play in the impact sector – just not for everyone. High-impact ventures, whose impact theme and business model require less turbo and more staying power, can easily fall through the cracks. If you have an unusual legal form, such as a registered association, steward ownership or a cooperative, the chances of successfully schmoozing with an impact VC are rather slim. Felix Schäfer from Bürgerwerke eG (pictured), a German impact venture with the vision of a renewable, regional and independent energy future in the hands of citizen cooperatives, has experienced this first-hand. His credo: “Cooperatives need good access to growth capital to realise their full potential for a sustainable economy.”

How to include the hidden impact champions?

The idea of broadening the usual investment horizon is therefore more than tempting. But how exactly can we include such hidden impact champions? Those whose positive external effects cannot be monetised (yet), whose business models are unusual or come with more organic growth trajectories? Those who think long term and want to grow into healthy medium-sized companies, without even having an exit on their radar screens?

- Read more: How to unlock VCs’ full impact potential

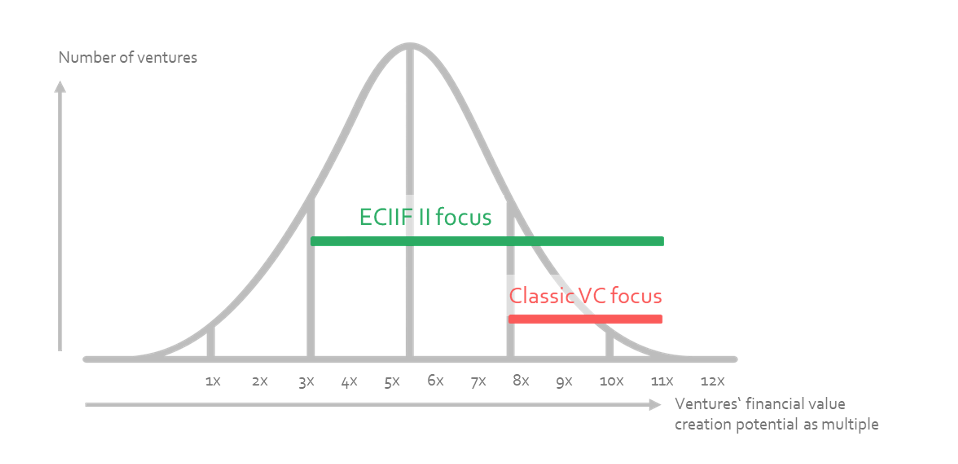

To answer this important question, we have embarked on the journey to create the European Catalytic Impact Investing Fund (ECIIF II). As the name suggests, there is a catalytic effect for Europe’s social innovation ecosystem at the core of the fund’s approach. One secret ingredient is the InvestEU guarantee provided by the European Investment Fund. This guarantee ensures that fund investors can still generate attractive returns in the case of defaults, as part of the potential losses are covered. This has the additional positive side effect that the rest of the portfolio is under much less pressure to outperform and offset such losses.

The focus of ECIIF II compared with classic VC

The second tasty ingredient is the expansion of the instrument pool to include self-liquidating mezzanine capital in the form of convertible loans. In other words: no exit necessary, but upside for investors. If you add a systemic approach to the mix, that is, a fund strategy that understands the close interconnection between impact themes and thus diversifies broadly, the result is an exciting recipe for the future. The greater vision behind it? Instead of losing momentum behind the US and China, Europe could finance a new, innovation-driven impact middle market that is fit for the future.

Everwave, funded by the predecessor fund of ECIIF II, is quick to confirm this vision. “We started our company in 2018 to reduce ocean pollution,” explains Clemens Feigl, founder and CEO (pictured). “Our solution stops plastic waste at the point of entry into the oceans, at large rivers, and we are building infrastructure for recycling on top.” Financing through classic VCs, however, was never really an option for the impact enterprise. “It took us four years to create a functioning B2B business model based on innovative plastic credits. When I spoke to impact VCs in earlier fundraising rounds, I often had the impression that although the word impact was on their labels, they were only interested in returns. That has changed recently.”

Everwave, funded by the predecessor fund of ECIIF II, is quick to confirm this vision. “We started our company in 2018 to reduce ocean pollution,” explains Clemens Feigl, founder and CEO (pictured). “Our solution stops plastic waste at the point of entry into the oceans, at large rivers, and we are building infrastructure for recycling on top.” Financing through classic VCs, however, was never really an option for the impact enterprise. “It took us four years to create a functioning B2B business model based on innovative plastic credits. When I spoke to impact VCs in earlier fundraising rounds, I often had the impression that although the word impact was on their labels, they were only interested in returns. That has changed recently.”

In the most recent fundraising, which FASE actively supported, Everwave made a conscious decision to focus on profitability rather than pushing revenues. This contributed to the round's great success. “I want to become a fund returner,” confirms Clemens, “but at the same time, our primary goal is to be impact first and solve a huge problem. This vision also creates an incredible bond within our team. In the medium term, I think that cases like ours are more successful, also because they are not so interchangeable.”

You could say that the signs point to innovation — away from the classic VC model as the only solution for impact startup financing and towards an independent path for Europe’s impact ecosystem. But this requires collaboration. If you feel the same about Europe’s impact future, join us on the journey! More information about the ECIIF II is available at www.eciif.eu.

Header image: Everwave’s boats remove plastic waste from rivers, stopping it getting to oceans.

This feature remains free to read thanks to the support of our partner, FASE. Find out more about our partnerships

| Ready to invest in independent, solutions-based journalism?

Our paying members get unrestricted access to all our content, while helping to sustain our journalism. Plus, we’re an independently owned social enterprise, so joining our mission means you’re investing in the social economy. |