UK social impact investment market tops £11bn in 2024 – Better Society Capital

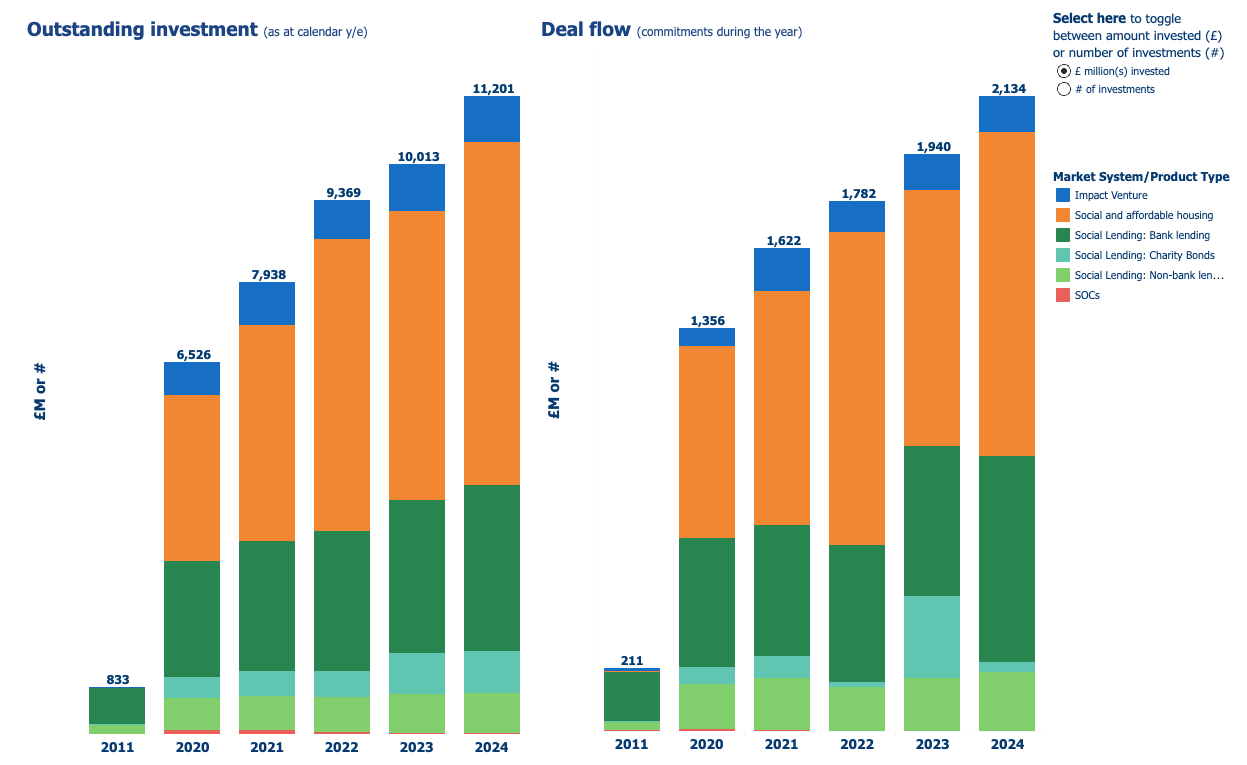

New research from the UK’s social investment wholesaler shows a 12% year-on-year increase largely driven by a jump in investment in social and affordable housing, while the picture is more mixed in other segments of the market.

UK social impact investments reached £11.2bn at the end of 2024, a 12% year-on-year increase driven by renewed activity in social and affordable housing, according to Better Society Capital’s latest market study.

The research, published today, reveals a record £2.1bn-worth of social investments were made in the 2024 calendar year, across just over 1,100 deals.

Stephen Muers (pictured), CEO of Better Society Capital, told Pioneers Post: “We do still see growth, and we think that is sustainable growth, because the needs are still there and there's still more organisations that can grow, take on more investment and make a difference… It won't always be a straight line – it's always volatile and bouncing around.”

Stephen Muers (pictured), CEO of Better Society Capital, told Pioneers Post: “We do still see growth, and we think that is sustainable growth, because the needs are still there and there's still more organisations that can grow, take on more investment and make a difference… It won't always be a straight line – it's always volatile and bouncing around.”

The growth was largely driven by an increase in investments in social and affordable housing funds, which now account for 54% of the market. Outstanding investments in social and affordable housing were up 18% year-on-year, reaching £6bn at the end of 2024, following a period of stagnation in 2023. Volumes of capital invested in the sector in 2024 were up 27% compared with the previous year, reaching £1.09bn.

Muers said investment volumes in social housing were “inherently lumpy” because of the large sums of money involved in housing deals, so it was important to look at longer-term trends as there could be a high level of fluctuation each year. Outstanding investments in social and affordable housing grew at an average yearly rate of about 16% since 2021.

Other segments – including lending to social enterprises and charities, investment in impact ventures and social outcomes contracts – showed a mixed picture of slow growth or decrease.

What is social impact investment?Better Society Capital defines social impact investment as follows: “Investment into social purpose organisations such as charities, social enterprises, start-ups, or real assets such as social and affordable housing. The investment enables them to deliver products or services that create measurable, lasting social impact that improves people’s lives. Social impact investors are seeking positive social impact as well as a financial return and both investees and investor demonstrate social impact intent.” |

New dormant assets funding ‘really important’

In the foreword to the research, Muers welcomed recent policy developments – the launch of the £500m Better Futures Fund, which is an outcomes fund to support vulnerable children, and the recent creation of the Office for the Impact Economy in the Cabinet Office, as a “central point of contact” with government for social investors and purpose-driven business.

He said: “These developments signal an important step towards aligning social investment with national priorities – from job creation and enterprise growth to public service reform and housing.”

Social lending – lending to social enterprises and charities – experienced subdued growth in 2024, up just 6% on the previous year at £4.4bn. In 2023, the segment grew 16%. In particular, non-bank lending – debt finance taken on organisations to provide working capital and growth finance, which includes blended finance tools, grew only 3% over the 2024 calendar year.

Muers said that while “a few months ago, that [segment was] what we worried about”, the recent confirmation of the allocation of £87.5m of dormant asset funding to social investment through to blended finance wholesaler Access, the Foundation for Social Investment, put this segment in a “much stronger place going forward”.

That bit of the market would have got really stuck had that money not been released

“That is really important, because that bit of the market would have got really stuck had that money not been released,” he added.

At a glance: UK social investment in 2024

|

Impact ventures: not immune to global headwinds

Investments in impact startups, which represent 7% of the market, contracted in 2024, down 1%. Deals made in 2024 totalled £121m, similar to 2023 levels.

This comes amid a global drop in investor interest in impact startups over the past few years, following record-high levels of investments in 2021. In 2024, research from startup data platform Dealroom found that impact startups had seen a 20% drop in venture capital investments. Dealroom expects investments in impact startups to fall by another 24% this year.

In its research, Better Society Capital says its data is a “conservative estimate” of the level of investments in impact ventures, and notes that its ImpactVC initiative continues to attract interest, with membership growing to 750 since its launch in 2023.

Muers said that the impact venture sector was experiencing a “reset” after abnormally high valuations in the broader VC market earlier in the decade, and was facing the same economic headwinds as the rest of the market. “Impact investment is caught up in that wider picture, and it's not immune from it.”

Social outcomes contracts: a future story

Outstanding investments in social outcomes contracts shrank to £13.5m – less than 1% of the overall market – but the recent launch of the Better Futures Fund is fueling hopes that outcomes partnerships will flourish in the next few years.

“This is now a future story,” said Muers. “There haven't been new funds or new investments in this space for a long time. The Better Futures Fund is completely game changing.”

The Better Futures Fund is completely game changing

But he warned not to expect spectacular increases at once because by nature social outcomes partnerships were a long-term process.

He said: “It will show up in this data really slowly, because it's over quite a long period of time… so the flow of capital will actually build up pretty gradually. So you won't see this in 2025 numbers. You'll see virtually nothing in 2026 numbers.”

In social outcomes partnerships or contracts (also known as social impact bonds), social investors pay for social enterprises or charities to deliver a service commissioned by public authorities; if pre-agreed social outcomes are achieved, the government then repays the investors, with interest. The Better Futures Fund will provide the dedicated funding to pay back investors when outcomes are met.

- Read more: What are social outcomes partnerships?

Muers said today’s data was a way for Better Society Capital to look to the future as it developed its new 2026-2030 strategy, to be revealed in the next few months. “This is great that we've got above that £10bn mark [an objective of its previous strategy] and now continue growing. But the big question next is, where does that need to grow more to have the biggest impact on the issues that matter?”

Better Society Capital’s annual research is based on 100 different funds or social investment programmes that meet BSC’s criteria of social impact investment in the UK, including fund managers, intermediaries and social banks that make direct investments into social enterprises and charities, projects, and real assets.

Top image: Emma Dodd (left) with her sister Aynsley. Emma is a new tenant of the The Old Eight Bells, a development to create homes for people with learing disabilities funded by the Resonance Supported Homes Fund which opened last September.

Create your own user feedback survey

| Ready to invest in independent, solutions-based journalism?

Our paying members get unrestricted access to all our content, while helping to sustain our journalism. Plus, we’re an independently owned social enterprise, so joining our mission means you’re investing in the social economy. |