Overheard at COP26: Carney, Fink, Sturgeon and more

The Glasgow talks – and hundreds of fringe events – are wrapping up today, but what next for business and finance? Hear what some ministers, CEOs and impact investing leaders have to say, in our pick of the fortnight's quotes.

‘We have all the money we need’: Mark Carney, UN special envoy for climate action and finance

“Up until today there was not enough money in the world to fund the transition… Right here, right now is where we draw the line. The $130tn is more than is needed for the net-zero transition globally.

“With Gfanz [the Glasgow Financial Alliance for Net Zero], we have all the money needed for the transition. Our job is to have the plumbing that helps put it to work.”

Read more from Mark Carney (pictured above) on Pioneers Post, or watch his full speech here.

‘How do you change your understanding of prosperity?’: Teresa Ribera, minister for the ecological transition, Spain

“System change is always something that creates unfair and dystopian reactions from people… You are going to challenge GDP or development because of the planetary boundaries, but what do ‘planetary boundaries’ mean? These types of discussions are difficult: how do you change your current understanding of prosperity for something that it is not clear in terms of what it means and how you can build it?

“For a long time, the political energy was focused on attracting the economic players… it's true, we need economic players involved in this transformation. But what about the people receiving those messages? Is this a business plan - or is this something for people? We need to pay attention to hope, and to people's expectations, this cannot only be a story for business opportunities, it can be a story for people. [To achieve that] the role of government is absolutely key.”

‘Our action is to rewire the entire global financial system’: Rishi Sunak, chancellor of the exchequer, UK

“What matters now is action: to invest that capital in our low carbon future. To do that, investors need to have as much clarity and confidence in the climate impact of their investments as they do in the traditional financial metrics of profit and loss. So our… action is to rewire the entire global financial system for net zero.

“Better and more consistent climate data. Sovereign green bonds. Mandatory sustainability disclosures. Proper climate risk surveillance. Stronger global reporting standards. All things we need to deliver and I’m proud that the UK is playing its part.”

Read the full speech.

‘Green finance is a critical pillar’: Ukur Yatani Kanacho, finance minister, Kenya

“We consider climate or green finance as a critical pillar to countries for the realisation of the development goals and obligations. Because we believe that mobilising these innovative mechanisms for mobilising capital – especially from private capital sources – with a view of developing new and improved infrastructure as a way of securing alternative sources of food and water… Green bonds offer an asset that is quite attractive in terms of finance mechanisms.”

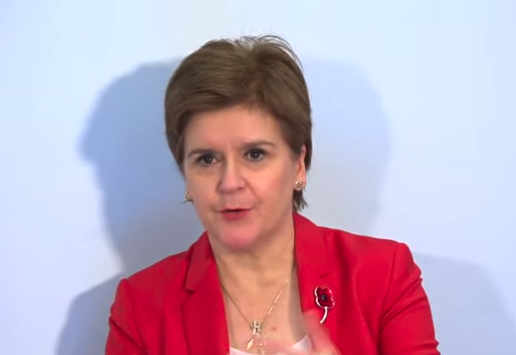

‘We have a happier, healthier population with inclusive economic growth’: Nicola Sturgeon, first minister of Scotland

“Economic growth on the one hand, and social inclusion and equality on the other hand, are often described as in competition, when in actual fact, they are two sides of the same coin. We have a happier and healthier population if we've got an economy that is growing in an inclusive way.

In terms of the transition to net zero, it can't be that the costs all fall on individuals… There has to be significant systemic investment into making that transition, much of it has to come from the government, but there has to be increasingly government-private partnerships.”

‘Impact investing is absolutely crucial now’: Cliff Prior, CEO, Global Steering Group for Impact Investing

“Technically we can solve the climate challenge, but a very substantial disruption is going to happen. Unless people feel a tangible sense of social justice, they’re not going to come on board… A just transition is ethically right, and even for the deepest green activist it’s essential.

“Impact investing is absolutely crucial right now... if you haven't got a finance system that is positively designed to achieve social and climate goals, you haven't got a chance.

“The question is, do you use the financial system that we have and stick these extras on – or do you say we need a new financial system overall? A 1930s financial system needs a pretty big overhaul. But there is what would be ideally right and what you can get quickly enough to meet the challenge. It doesn’t need to be perfect.”

Read the full story on Pioneers Post.

‘This is not about judging’: Laurie Spengler, founder and CEO, Courageous Capital Advisors

“It’s ‘and’ not ‘or’. People and planet. Social and environmental.

“We are trying to break through the notion of “I will act when you act”. We don’t have time for that. We need to be thoughtful: how can everyone take a step forward? We need to create a framework where each of these actors take a step forward.

“Big private equity firms are now bringing impact products to market. With integrity, transparency and harmonisation we'll be able to see the differences. This is not about judging. It's about assessing where that money is really flowing, to whom and where.”

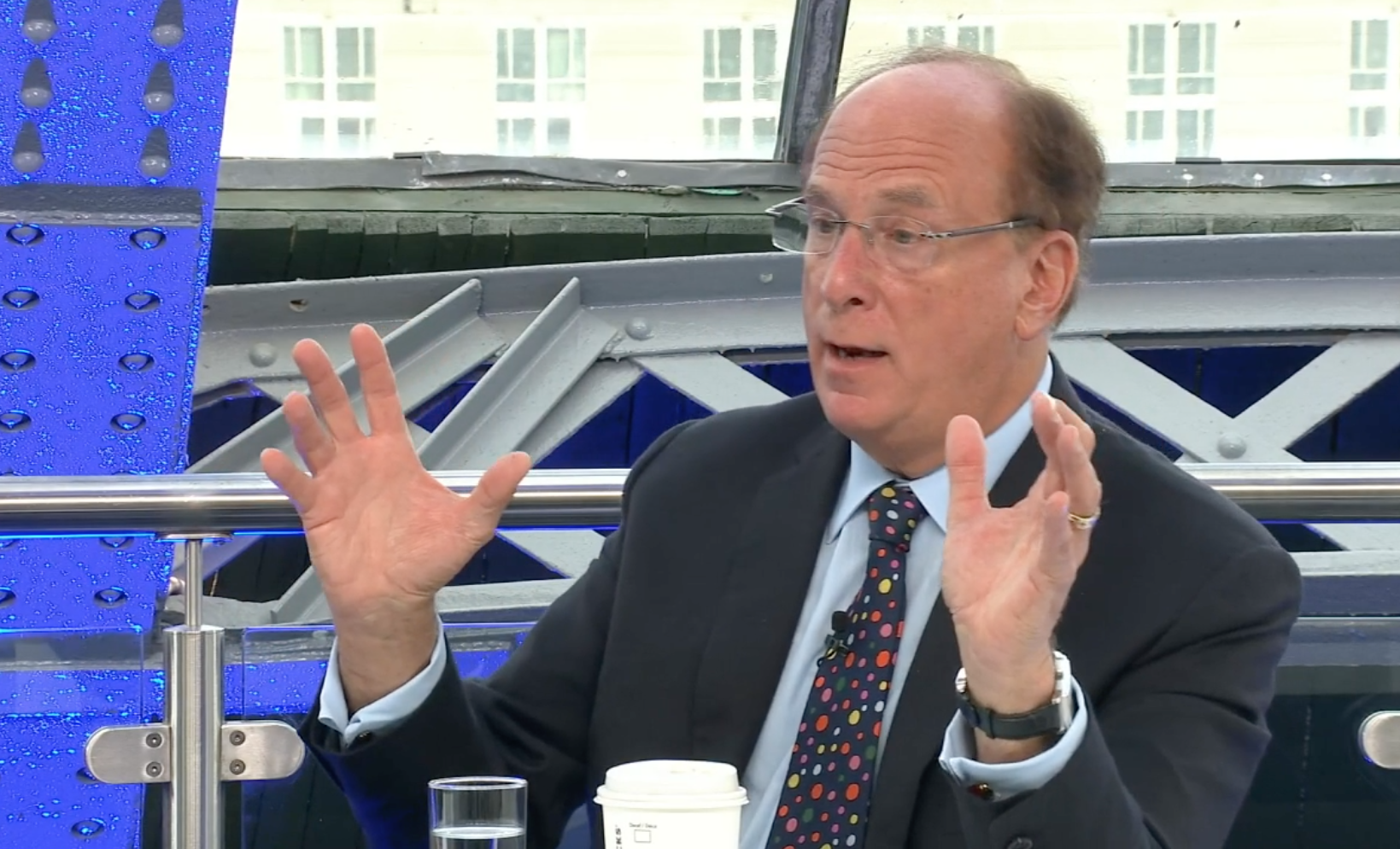

‘We need a fair and just transition’: Larry Fink, CEO, Blackrock

“We need a fair and just transition. If we're not getting a fair and just transition, we're going to create more polarisation in the world and more political uncertainty.”

“We have to have the same intensity [as in the race for a Covid vaccine], and we're going to have those breakthroughs. But it requires a lot of public investing alongside private investing. And I don't see that happening enough.”

Read more on Pioneers Post.

Photo of Rishi Sunak by Chris McAndrew on Wikimedia Commons

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.