Better terms, better impact – but can impact-linked finance overcome a chicken-and-egg situation?

How to incentivise social entrepreneurs to make even more impact? How to protect impact businesses against mission drift? Impact-linked finance, the youngest kid in the impact investing family, offers some solutions.

Social enterprises want to make a big impact. To do so they need capital, but the wrong kind of investment can pull them away from their core mission. The solution, say some, lies in a concept that combines new and existing tools: impact-linked finance.

Impact-linked finance is a form of funding that rewards social enterprises for the positive impact they create. That means a social enterprise will enjoy better financing terms – a grant payment alongside a loan or equity, or lower interest rates, for example – if they meet specific impact outcomes, and therefore are incentivised to grow their impact.

“It’s better terms for better impact,” says Lucas Tschan, head of advisory and partnerships at iGravity, a Zurich-headquartered firm specialised in impact investing and innovative development finance, which manages two impact-linked funds.

But how does it work – and what impact can it have?

| Join the FASE Impact Fire Talks on 28 March - 1 April to discuss incentivising impact, exit scenarios, behavioural bias and more. |

A family of financial tools

Some impact-linked finance tools involve a donor who “pays for impact” – with the guarantee that their money will be used only to the extent that impact outcomes are met. Those are often foundations, philanthropists or public sources of finance. Meanwhile social enterprises receiving this kind of impact-linked finance are enabled to take on other investor capital to support and grow their business while remaining in line with their impact objectives. In other impact-linked finance tools, investors are ready to make concessions on their financial returns once predefined outcomes are achieved.

The goal of the model is to make high-impact enterprises more attractive to private sector investment, enabling them to generate further impact.

Many social venture funds want the best of both worlds: to beat the market and to save the world simultaneously. In my experience, this does not happen too often

Impact-linked finance differs from social impact bonds (SIBs) because it is designed to support the entire social enterprise business model, whereas SIBs fund specific, time-bound projects.

The two types of impact-linked finance most commonly used are social impact incentives (SIINCs) and impact-linked loans – although the principle of impact-linked finance can be embedded in a variety of financial instruments, from equity to guarantees.

- Read: Elena Casolari: 'We invest in solutions that are still being moulded into shape'

SIINCs, which were pioneered in 2016 by impact advisory firm Roots of Impact (which later created the concept of impact-linked finance), are grants given to social enterprises on the condition that they achieve certain predefined impact outcomes. The investees must also raise private financing alongside it.

Impact-linked loans are loans made to a social enterprise where the repayment modalities depend on the impact achieved by the business: the bigger the impact, the lower the interest rates.

There are options to develop impact-linked finance beyond debt and toward equity financing, Tschan explains, although that's still at an experimental stage.

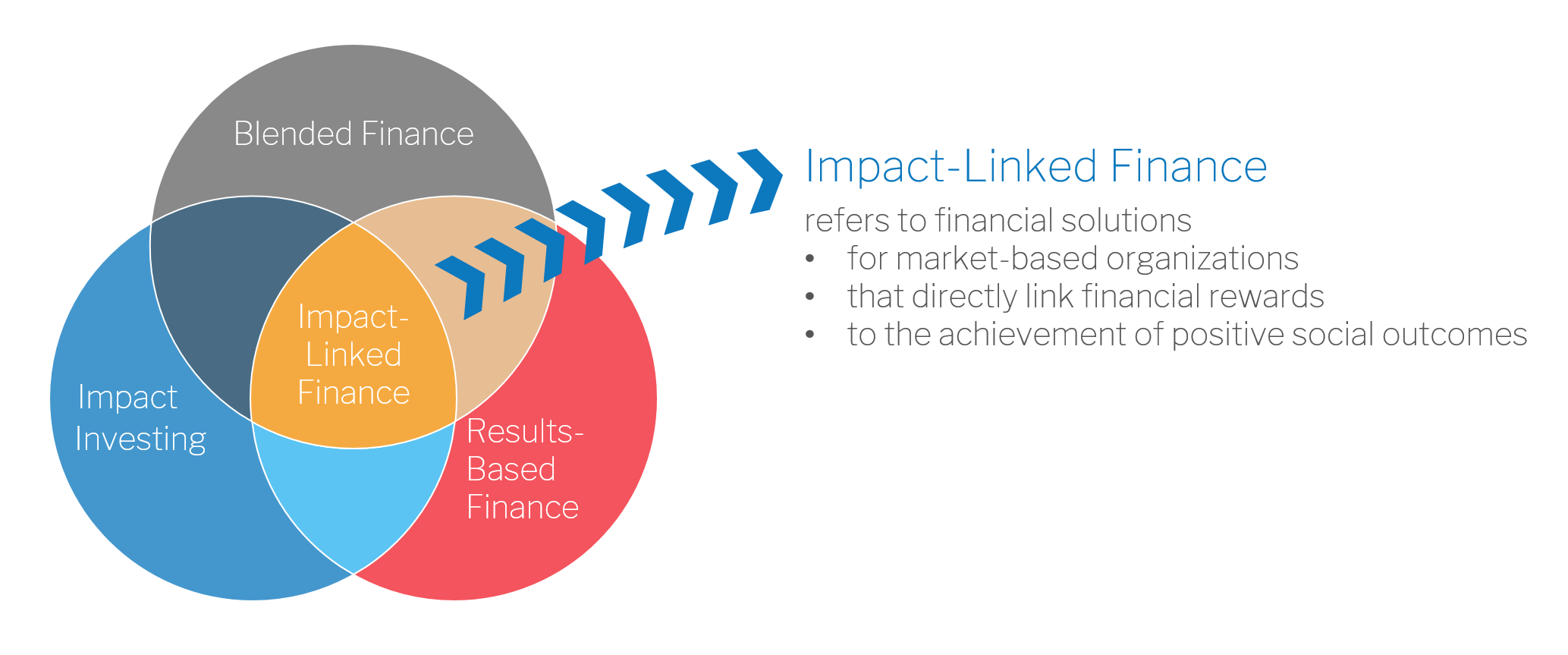

Diagram: Impact-linked finance sits at the intersection of impact investing (its goal is to create positive social or environmental impact), blended finance (it mixes grants and repayable finance), and outcomes-based payments (the terms of the transactions depend on the impact generated).

Together with Roots of Impact, iGravity has launched two impact-linked funds, the Impact-Linked Fund for Education and the Impact-Linked Fund for Eastern and Southern Africa. Their focus so far is on the Global South and in particular the least developed countries, because they feel this is where they will make the most impact, Tschan explains – although he recognises that there is a need for it everywhere.

iGravity and Roots of Impact are currently involved in more than 50 impact-linked finance transactions that are in various stages, from pipeline to preparation to completion. Out of these transactions, 30 are using SIINC and more than 20 apply other instruments such as impact-linked loans, impact-linked revenue sharing agreements, impact-linked grants or impact-ready matching funds.

Because the practice is in its early stages, there are a limited number of cases to prove that the concept works, but advocates are confident that these signal its potential to succeed. More of those examples are needed, Tschan (pictured) says, although inevitably, to have more case studies, more deals need to happen. “It’s always a bit of a chicken and egg thing,” he adds.

Because the practice is in its early stages, there are a limited number of cases to prove that the concept works, but advocates are confident that these signal its potential to succeed. More of those examples are needed, Tschan (pictured) says, although inevitably, to have more case studies, more deals need to happen. “It’s always a bit of a chicken and egg thing,” he adds.

A 2021 study commissioned by the UK’s Esmée Fairbairn Foundation found there was considerable energy and enthusiasm for impact-linked finance among the impact investing community and in particular among practitioners, although the lack of a track record meant some investors remained sceptical of the approach.

- Read more from FASE: Beyond warm glow: why early-stage social ventures need more impact-first finance

‘In our DNA’

So far, investors in impact-linked finance have been philanthropic-minded organisations, mostly foundations, donors and the public sector. For example, iGravity has been working with the Zürich-based Jacobs Foundation – which had been pioneering impact investing for a long time – and Liechtenstein-based Medicor Foundation. Public funders, such as SDC, the Swiss development agency, have also been involved in impact-linked finance.

DRK Foundation has also been using impact-linked finance tools to invest in early-stage social enterprises for the past three to four years. The foundation is still learning from other investors and entrepreneurs, but for Kanini Mutooni (pictured), the foundation’s managing director, it’s a no-brainer.

“It's in our DNA,” she says. “That's how we deploy our capital, if we don't link our capital to impact, then we're actually not aligned with our own mission.” She sees it as the only way to tackle today’s most pressing issues; and a guarantee that the private capital they mobilise will be linked to impact too.

Mutooni explains that linking financing with impact outcomes is now a consideration in all their deals. But she warns against a “blanket approach” to impact-linked finance – different social enterprises will need different types of finance, so it’s about “integrating it in every deal” and customising approaches to the kind of company, the sector and the region they’re in – social entrepreneurs in Latin America will not have the same needs as those in sub-Saharan Africa, for example.

There are different ways DRK uses impact-linked finance. The most basic is to provide capital in “tranches”: the first tranche is given upfront, but the following tranches are only provided if certain outcomes are met.

Another way is to use revenue-based financing (or mezzanine financing, where payment to investors depends on the company’s financial performance), but to link it to impact outcomes rather than just revenue, incentivising social entrepreneurs to increase their impact in order to lower the cost of capital.

That's how we deploy our capital, if we don't link our capital to impact, then we're actually not aligned with our own mission

Impact-linked finance also guards against mission drift, advocates say. For example, social enterprises serving bottom-of-the-pyramid customers might want to shift their services to the middle- and higher-income groups if they’re looking to grow their income; but that would lower their impact. If their impact is a condition to getting investment, or to getting better terms for investment, then the social enterprise will be incentivised to prioritise its mission.

Impact-linked finance in action: Clínicas del AzúcarIn Mexico, Clínicas del Azúcar is a social enterprise providing affordable specialist medical services for diabetic patients. It was granted SIINCs by the Swiss Agency for Development and Cooperation (SDC) on the condition that it continue to serve customers in lower-income groups, rewarding it for its impact, while at the same time enabling it to take on private investment to grow its activity. This prevented the company from shifting its focus towards higher-income customers to grow its revenue, a route it could have pursued without the incentive provided by the SIINC grant. |

Difficult question

The need for a grant element in impact-linked finance is at odds with the assumed wisdom that impact investors can make market-rate returns while creating a deep social impact. But for iGravity’s Tschan, investors have to accept that having the best of both worlds isn’t always realistic.

“It's a bit of a difficult discussion, because we are really focusing on the impact created and relaxing the financing terms. For impact investors, most of the time, it's the other way around: they want to guarantee the financial return and at the same time, get some social or environmental impact. So I think what needs to happen is a bit of a change of mind.”

Transaction costs alone, which are relatively high because deals are small-scale and must be tailor-made for each social enterprise, would be difficult to accept for an asset manager, Tschan says. But for a foundation, impact-linked finance is already a big step forward from the “minus 100% return” of their traditional grants.

Markus Freiburg (pictured), the co-founder and managing director of the Financing Agency for Social Entrepreneurship, a Germany-based advisory firm specialised in helping social enterprises raise impact investment (often impact-linked finance), also says that there is a certain amount of trade-off between the impact created and the level of financial return that investors can expect.

Markus Freiburg (pictured), the co-founder and managing director of the Financing Agency for Social Entrepreneurship, a Germany-based advisory firm specialised in helping social enterprises raise impact investment (often impact-linked finance), also says that there is a certain amount of trade-off between the impact created and the level of financial return that investors can expect.

For him, while the “lockstep model” usually works (i.e. the more active a social enterprise is, the more money it makes and the more impact it creates), there is a misunderstanding regarding the level of the financial return that impact investors can achieve. “We see many social venture funds that are really looking for classic venture capital types of return – they really want to have the best of both worlds: to beat the market and to save the world simultaneously. And in my [experience], this does not happen too often.”

The holy grail: defining impact

Impact-linked finance however comes with a common headache: how do investee and investor know for sure when the impact has been achieved? Impact measurement is “the holy grail for this sector,” says Tschan. But there is no easy solution: smaller organisations lack capacity to measure impact, and the amount of investment secured (investments range typically between US$200,000 and $600,000) doesn’t justify spending much of it on impact measurement.

Tschan explains that the level of requirements needs to be proportionate to the size and capacity of the social enterprise, and it’s a matter of balancing the reporting requirements of the donors – who want to trust that their money is used for impact – with the reality of what social enterprises on the ground are actually able to provide.

At DRK Foundation, all social enterprises are required to follow a specific impact measurement methodology – that looks both at the broad outcome (for example, how many people have gained access to clean water) and then specific considerations (how many of those were women, how many could improve their livelihoods as a result, etc). The foundation provides hands-on training and support to help social enterprises measure impact.

Knocking on doors

Mutooni stresses that impact-linked finance, despite its effectiveness, is yet to take off. “The industry has been talking about it for a while, but there's been different stages of application and execution. So I think there's been more talk than there has been practice to date.”

A major barrier that impact-linked finance advocates face is the lack of awareness. Some foundations are quite advanced, training their staff and communicating about it, but much of iGravity’s work, Tschan explains, is to knock on foundations’ doors to explain the concept. The firm is also building connections with accelerators to reach potential investees.

Sometimes entrepreneurs mistrust investors so you have to build that trust relationship to be able to show why that instrument makes sense

Mutooni says that in her experience, few entrepreneurs know about impact-linked finance, so there’s a lot of work to be done in explaining the mechanisms and building trust, and some will also be put off by the complexity of the product. “Sometimes entrepreneurs mistrust investors so you have to build that trust relationship to be able to show why that instrument makes sense,” she explains.

One big part of the foundation’s work, she adds, is reaching out to the high-potential social enterprises which will most benefit from impact-linked finance. “Sourcing is the thing that we spend most of our time doing,” says Mutooni.

To accelerate the use of impact-linked finance, Mutooni says, the best thing to do is to show it in action, by sharing case studies – to show how impact finance works in practice, and why it works, so people can learn from this and start thinking about doing the same. “If we do a deal, we should share it,” she says. “Talk about it and really push it into the ecosystem to show what's possible.”

This feature was produced in partnership with FASE. Lucas Tschan, Kanini Mutooni and Markus Freiburg will be speaking about impact-linked finance on Monday 28 March, as part of next week’s FASE Impact Fire Talks. Sign up for this and more talks here.

Top picture: social enterprise Clínicas del Azúcar, which provides affordable specialist medical services for diabetic patients in Mexico, benefited from impact-linked finance (credit: Clínicas del Azúcar)

Thanks for reading our stories. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.