Latimpacto launches first study into venture philanthropy in Latin America

Latimpacto, the Latin American venture philanthropy network, this week published its first study of the venture philanthropy ecosystem in the region, with the aim of catalysing more innovative investments across Latin America and the Caribbean in the next two years.

The network of philanthropists and social investors launched during 2020 and is closely linked with EVPA in Europe, AVPN in Asia, AVPA in Africa and the International Venture Philanthropy Center.

The Latimpacto research, Inversión Social e Impacto: Casos y Tendencias en América Latina (Social Investment and Impact: Case studies and Trends in Latin America), began with 187 interviews with professionals in the venture philanthropy – or what the movement calls the “investing for impact” – ecosystem. After that, 120 initiatives were mapped and eventually the researchers created 37 detailed case studies from seven countries.

A study published in September 2020 by the Aspen Network of Development Entrepreneurs, Impact Investment in Latin America: Trends 2018-2019, has already identified US$3.7bn in impact investments in the region, compared with the global impact investment market of US$715bn.

Three consultancies carried out the Latimpacto research: Pipe Social in Brazil, Compartamos con Colombia and Mexican think tank Ethos.

Speaking at the launch on 22 February 2021, Johnatan Clavijo, from Compartamos con Colombia, said: “We wanted to be inspirational. This report needs to be an inspiration to drive other organisations to join the conversation. The conversation can go beyond the borders of our countries in Latin America.”

This report needs to be an inspiration to drive other organisations to join the conversation

Alan Wagenberg, Latimpacto’s knowledge centre director, said: “In two years, when we do this study again, we would like the actors in the continuum of capital to work in a more collaborative way, complementing one another.”

He added that he also wanted to see “a greater appetite for risk” and “a greater capacity for innovation”.

Latimpacto CEO Carolina Suárez Visbal said: “It is a great pleasure to provide the first investing for impact study at the service of our community. This study will allow us to learn about trends regarding which instruments countries are using to support social purpose organisations, what type of non-financial support is being provided so that the deployment of capital is more effective and catalytic, how impact is being measured and managed, and how social investors are generating greater resilience among social organisations during the pandemic.”

Around 200 people joined the online launch event which gave an overview of the main trends that the researchers had identified. Further events this week will focus on some of the case studies and main themes.

Key trends identified in the Latimpacto case studies

|

Opportunity for more environment-focused investments

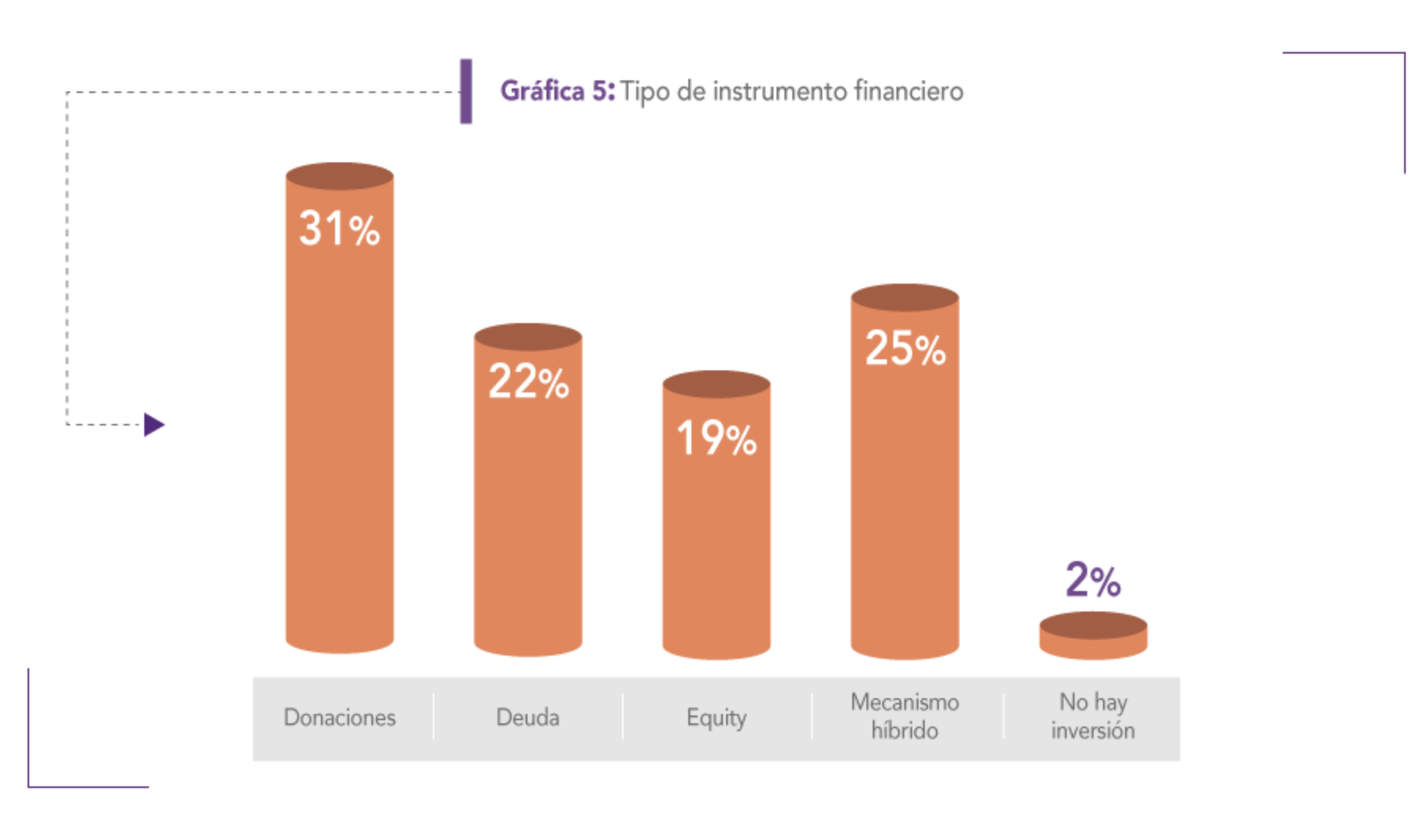

Wagenberg said that it was a “good surprise” to find that a quarter of the case studies were using hybrid mechanisms for investment – combining two or more types of financing such as grants and debt.

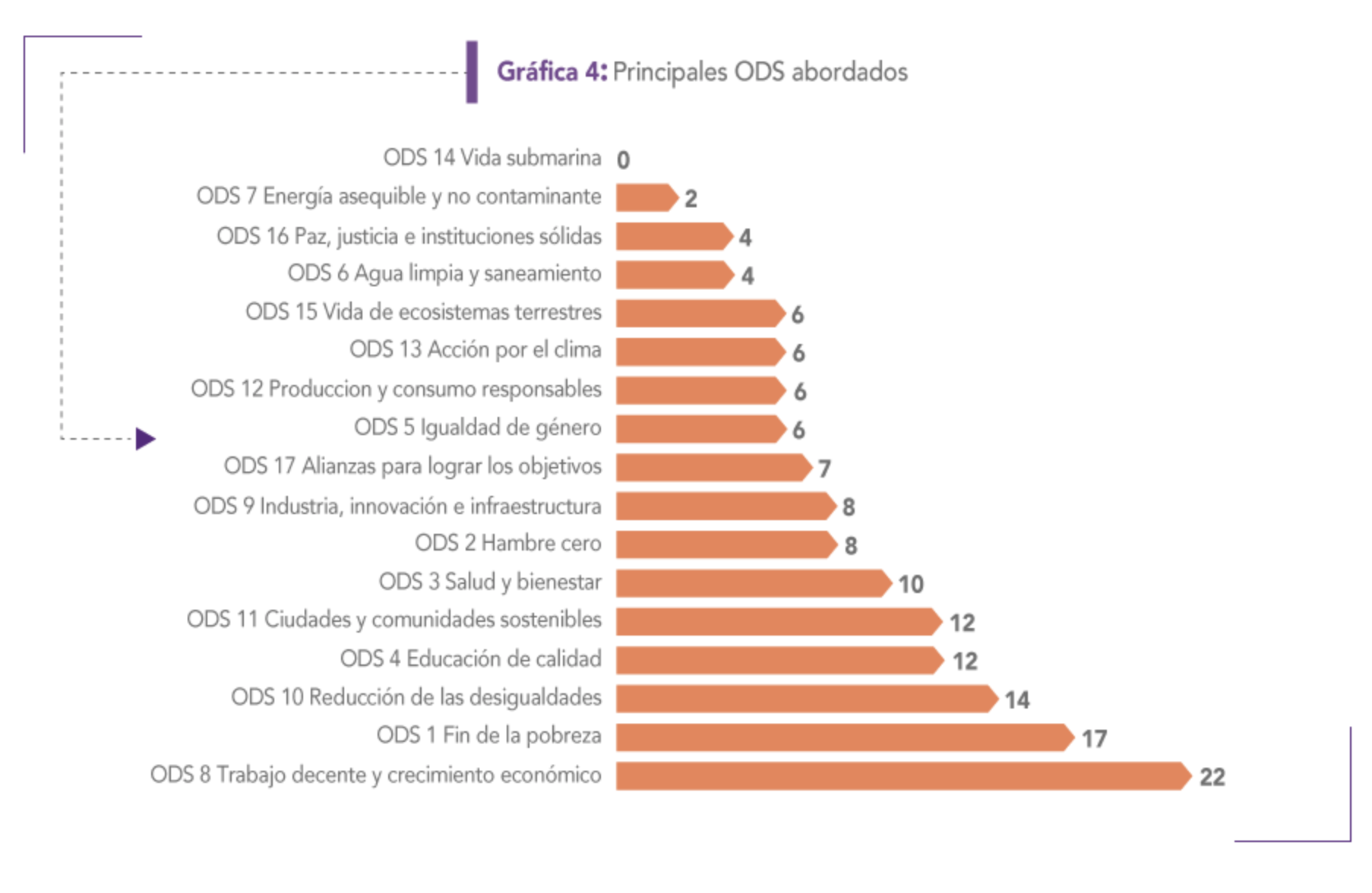

Wagenberg also noted that there was a lack of investment in rural issues and the environment in the region. He said: “Latin America has great biodiversity and we suffer because of climate change and surprisingly there are not many resources going into these areas. This is a challenge and a great opportunity.”

The UN Sustainable Development Goals tackled by the 37 case study projects. Graph from Inversión Social e Impacto: Casos y Tendencias en América Latina

The UN Sustainable Development Goals tackled by the 37 case study projects. Graph from Inversión Social e Impacto: Casos y Tendencias en América Latina

• The full report will be published in Spanish, Portuguese and English in the coming weeks. See the website Inversión Social e Impacto: Casos y Tendencias en América Latina for more.

Header photo: Boy drinking cocoa in Manaus, Brazil. Photo by Julio Pantoja/World Bank, reproduced under a Creative Commons licence

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.